Know Your Accounts Office Reference Number (AORN)

After setting up a business in the UK, when a business registers as an employer, if you employ staff, HMRC issues Accounts Office Reference Number (AORN) and Employer PAYE Reference (ERN). This unique code is assigned to you when you register as an employer, and it plays an important role in identifying your business when you send payroll information and pay deductions like Income Tax and National Insurance.

For UK employers, the number is not just a formality, it's vital to process payroll efficiently and keep your tax records accurate. Each time you make a payment to HMRC, you’ll need to include this number so that your payments are correctly matched to your account. If you forget it, you might face delays or even errors in recording, which could lead to some unwelcome letters or penalties.

In this guide, we’ll dive into what the Accounts Office Reference Number is all about, how to locate it, what to do if you misplace it, and the most common mistakes to avoid. If you're a new employer or simply need to get refamiliarised, you'll have easy, straightforward answers to guide you through this aspect of your payroll.

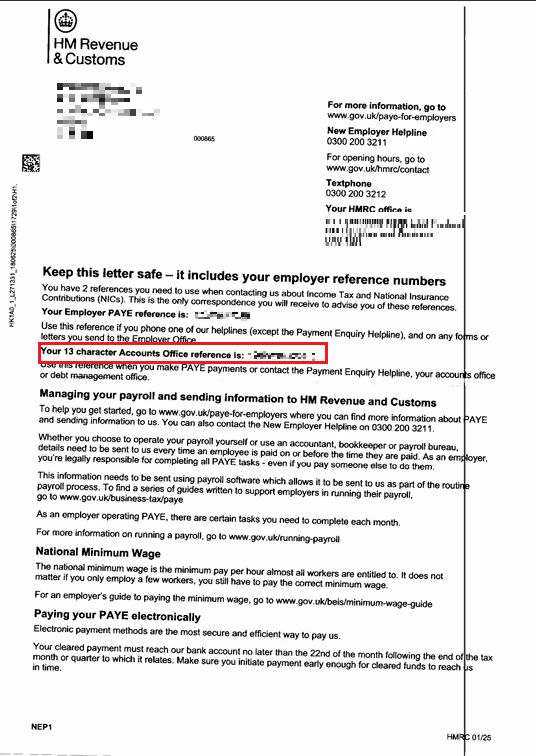

You can locate your Accounts Office Reference on the confirmation letter you receive from HMRC when you first register as an employer. The AORN contains 13 characters, and follows the format 123PA12345678.

What is an Accounts Office Reference?

An Accounts Office Reference number (AOR) is a 13-character identifier that HMRC sends your way within about 5 business days after you register your business, together with a new employer welcome pack.

It is also known as Accounts Office Reference or PAYE Accounts Office Reference.

The main job of the AOR is to help HMRC keep track of the tax and National Insurance (NI) contributions that businesses deduct from their employees' wages. Each time an employer pays over its payroll taxes, this reference number informs HMRC to whom the payment belongs and what particular tax account it should be credited to.

Briefly, the AORN is a tracking number. HMRC uses it to determine which company has made certain tax and NI contributions, so that there are no mix-ups or payment processing delays. Whenever a company submits payroll taxes, they must attach this number so that HMRC can record the payment correctly.

Accounts Office Reference Format

The format of an Accounts Office Reference Number is as below:

The total length of AORN is 13 characters which is sometimes extended to 17 characters to include ‘YYMM’ at the end for payments made by an employer relating to a specific period.

- First 3 characters are numeric

- 4th character is always ‘P’

- 5th character is an alpha character

- characters 6-12 are numeric

- character 13 can be numeric or ‘X’

Example: 123PA12345678. The first part relates to your tax office, while the rest is unique to your business.

Accounts Office Reference Number Example

Some examples of accounts office references are:

- 123PA12345678

- 123PA1234567X

- 123PA123456781511

The additional 4 digits you add to your 13-character accounts office reference number depend on whether you pay:

- monthly

- quarterly

- annually

For example, if you pay PAYE tax monthly, additional 4 digits would be added as:

- the last 2 numbers of the tax year your payment is for

- the number of the month of the tax year your payment is for

Let's break this down: if you're paying PAYE tax for the period from July 6 to August 5, 2026, you'll need to add the numbers 2026 to the end of your accounts office reference number. Here's how that works:

- the tax year you’re paying for ends in 2026 = 26

- the month you’re paying for (6 July to 5 August 2026) is the forth month of the 2025/2026 tax year = 04

Learn about how to work out the extra numbers with examples here.

How to Apply for an Accounts Office Reference Number

To get an Accounts Office Reference Number (AORN), you need to register as an employer with HMRC. This typically happens when you decide to hire employees or start paying yourself a salary through your own limited company. Here’s a step-by-step guide on how to get AORN:

Step 1: Register as an Employer with HMRC

- Visit the HMRC website and register as a new employer. You’ll need a Government Gateway account to complete this step, so if you don’t have one, you’ll create it as part of the registration process.

- During registration, provide details about your business, including your company’s name, address, contact information, and the start date of your first payroll.

Step 2: Receive Your Employer PAYE and Accounts Office Reference Numbers

- After completing your registration, HMRC will automatically assign both an Employer PAYE Reference Number and an Accounts Office Reference Number.

- These numbers are important for managing your payroll and tax responsibilities. The Employer PAYE Reference identifies you as an employer, while the AORN links your tax payments to HMRC.

Step 3: Look for the Welcome Pack from HMRC

- After you register, HMRC will send you a welcome pack by post or electronically within five to seven days. This pack includes both your Employer PAYE Reference Number and your Accounts Office Reference Number.

- Save this welcome pack, as you’ll need both numbers for payroll processing, tax submissions, and other HMRC communications.

Step 4: Access the AORN in Your HMRC Online Account

- Once registered, you can also view your AORN in your HMRC online account under the ‘Employers’ section. This is a convenient way to access it whenever you need to make payroll submissions or check your tax records.

Where to Find Accounts Office Reference Number

If you’ve already registered as an employer, HMRC will have given you your Accounts Office Reference (AORN). You’ll need it regularly, so it’s worth knowing exactly where to look if you don’t have it to hand.

Lost Accounts Office Reference Number? Find it on:

1. HMRC Welcome Letter (Form P30)

When you sign up for PAYE for the first time, HMRC will send you a welcome pack in the mail. Inside, you’ll find Form P30, which clearly displays your Accounts Office Reference Number. This is usually the easiest way to locate it.

2. Employer PAYE Online Account

You can easily find your AORN by logging into your HMRC employer online account. Once you're signed in, just check under your PAYE details, and you'll spot the number right next to your Employer PAYE Reference. This is super useful if you've lost the paper copy!

3. Payroll Software Records

If you're using payroll software, you'll typically find your Accounts Office Reference Number stored in your business or employer settings. Most payroll systems store it there so it can be automatically included in your submissions to HMRC.

4. The cover of your payment booklet

5. PAYE bills

6. On Correspondence from HMRC

Your AORN will typically be found on most letters from HMRC that relate to PAYE and payroll. This includes things like payment reminders, tax statements, and year-end summaries. It’s a good idea to check any official HMRC letters you’ve saved, as the number is usually printed in the top right-hand corner.

What to Do if You Lose or Forget Your Accounts Office Reference Number?

If you can’t find your Accounts Office Reference Number (AORN), don’t panic, there are several easy ways to recover it.

1. Check Online via HMRC Services

If you want to check online, the fastest route is to log into your HMRC employer online account. Once you're in, navigate to the PAYE section, where you'll find your AORN listed right next to your Employer PAYE Reference. This method is super convenient if you have your Government Gateway login details handy.

2. Contact HMRC

If you can't access the account, you can contact HMRC directly or call the HMRC employer helpline. An adviser will ask you for some information about your business, like your company name, address, and Employer PAYE Reference, to help them track down your AORN.

Why is an Accounts Office Reference Number Important?

HMRC relies on this number to recognise your business and connect the payments you make for PAYE (Pay As You Earn) and National Insurance to the correct account. If you don’t have it, HMRC won’t be able to accurately match your payments, which could create some confusion about what you’ve already paid and what you still owe.

You’ll need this number when you:

- Submit payroll details to HMRC.

- Make payments for tax, National Insurance, and other deductions.

- Respond to HMRC letters or queries.

Unlock Your Financial Potential with GoForma

Your Accounts Office Reference Number is a small but vital part of running payroll in the UK. Keeping your payroll safe and using it correctly every time you pay HMRC not only makes the process smoother but also ensures your tax records are spot on.

It’s wise to establish a payroll system that securely keeps all your HMRC references, like your AORN and Employer PAYE Reference. This way, you’ll have everything at your fingertips whenever it’s time to submit payroll or make payments.

For added peace of mind, you might want to consider teaming up with a professional payroll advisor or small business accountant. They can handle the process, keep everything compliant, and give you more time to focus on running your business.

FAQs on Employer Accounts Office Reference

Is a UTR the same as accounts office reference?

No, a UTR (Unique Taxpayer Reference) is different from an accounts office reference. UTR is a unique 10-digit number HMRC gives to individuals and businesses registered for self-assessment tax. While Accounts Office Reference is a number used by an employer when making payments to HMRC.

Is my Accounts Office Reference Number the same as my PAYE reference?

No, they are different. Your PAYE reference is used for reporting payroll to HMRC, while your Accounts Office Reference Number is used when making PAYE and National Insurance payments.

What if I lost my accounts office reference number?

If you lose your Accounts Office Reference Number, you can find it in your HMRC online account, on HMRC letters, or by calling the HMRC employer helpline.

Can I Change My Accounts Office Reference Number?

No, you can’t change it. HMRC gives you one Accounts Office Reference Number when you register as an employer, and it stays the same for your business.

What is an example of an accounts office reference number?

A typical Accounts Office Reference Number looks like this: 123PA12345678 – three numbers, two letters, then eight numbers.

How long is an accounts office reference number?

An Accounts Office Reference Number is 13 characters long, made up of numbers and letters in a set format.

How long it takes to receive your AORN?

It usually takes five to seven working days to receive your Accounts Office Reference Number after registering as an employer with HMRC.

.png)