Company Year End Accounts Overview

<p>Approaching a company's first year-end can feel incredibly stressful, as there will be a lot of paperwork you need to file at this time.<br></p><p>In this article we provide you with a simple list of what you will need to do, along with a few tips to make the whole process easier for you. We finish with the penalties and deadlines for late filing.</p>

Filing Company Year End Accounts with HMRC

You will need to file your company tax return, also known as the CT600 form, online.

To do this you will need your company accounts and your corporation tax calculation.

You will also need to file a director's report, unless your company is a micro-entity. Depending on the size of your company, you might also need to include an auditor's report.

Filing Company Accounts with Companies House

You will also need to file a copy of your accounts with Companies House. There is an option on the HMRC website for joint filing.

Companies House also require you to complete an annual Confirmation Statement, detailing who owns your company and how many shares it has. This is easy to do online—provided you have not changed the way your company is structured.

Year End Accounts & VAT (HMRC)

If your company is VAT-registered, your VAT return will likely be due around the same time as your company year-end.

Do note that this doesn't apply if you pay your VAT monthly or quarterly, as the deadline will then fall one month and seven days after the end of each VAT period.

4 tips for making filing less stressful

Set up email reminders

Sign up for Gov.uk's email reminder service. This ensures that you will get a timely reminder a few weeks before your accounts and confirmation statement are due for filing.

You might remember it all now, but it is very easy to forget such things with the hectic pace of running a new business.

Be rigorous with your expenses

Ensure you record all your expenses, and keep a copy of all your invoices and receipts. This is especially important in the first year when you will incur all your start-up costs.

According to HMRC, expenses must be incurred "wholly and exclusively" for running your business to be allowable for tax purposes.

If you're unsure about which expenses you can or can't claim, a qualified accountant can help you out.

Your accountant will also be able to provide personalised advice, such as making recommendations for expenditure that you can bring forward to reduce your total profit.

Further reading:

Plan ahead for the upcoming year

It's important that you set aside time to map out financial plans for the upcoming year. Book a meeting with your accountant, so you can review the past year and identify any areas you can improve on.

You may want to discuss how you can cut down on your tax bill, manage your cash flow more efficiently or assess if the capabilities of your current accounting software is aligned with your business needs and future goals.

Ensure that you've kept proper records

Before you file your company year-end documents or returns, check that you've kept a copy of documents that are required to back up your calculations.

These include receipts, invoices, bank statements, records of income and more. Your records must be kept for six years from the end of the last financial year they pertain to.

Company Year End Accounts Filing Deadline

The best way to avoid these it to be aware of your responsibilities and keep good records from the start. The worst way is to leave everything until the last month before it's due.

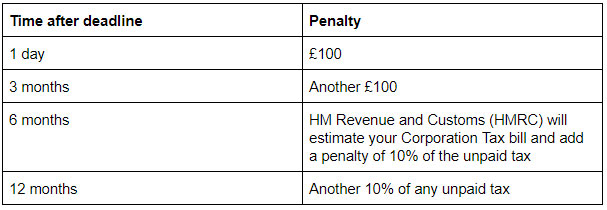

Company Year End Accounts Late Filing Penalties

Late filing penalties imposed by HMRC

Additional information:

- If you've submitted your tax return late three times in a row, the £100 penalties are increased to £500 each.

Late filing penalties imposed by Companies House

Additional information:

- The penalties are doubled if your accounts are late for two years in a row.

- You can be fined, or have your company struck off the register if you fail to send your accounts or confirmation statement to Companies House.

.png)