In this article

- Find a Company's VAT Number

- What is a VAT number?

- Why Do You Need to Find a Company’s VAT Number?

- 4 Places to Find VAT Number for a Company

- Finding Your Business VAT Number

- How to Find Your Business VAT Number

- What if I Lost My VAT Number?

- How to Check If a VAT Number is Valid

- Your Easy Next Steps for VAT Success

Find a Company's VAT Number

If you’ve spent any time trading with other companies, you’ve probably encountered the term “VAT number.” It’s essentially a unique identifier that HMRC assigns to UK businesses registered for Value Added Tax. This number is how HMRC keeps eyes on VAT payments and claims, and it’s how both businesses and clients can confirm that VAT is being handled properly.

From a business perspective, having your supplier’s VAT number isn’t just ticking a box, it’s about protecting your company from sending tax payments to the wrong place. For your clients, your VAT number on invoices gives them confidence that you’re operating within HMRC guidelines and that your invoices are genuine.

There are plenty of situations where you may need to find a company’s VAT number. Maybe you want to double-check an invoice before payment, confirm a supplier’s VAT registration, or ensure you’re eligible to reclaim VAT on expenses. This is especially crucial if you’re dealing with companies overseas, where compliance checks are a bigger deal.

In this guide, I’ll highlight four reliable places where you can find a company’s VAT number in the UK. This way, you can streamline your processes, avoid mistakes, and ensure the businesses you work with are reliable.

What is a VAT number?

A UK VAT number, also called VAT registration number, is essentially the official stamp that a business is registered for Value Added Tax. Not every business needs one, only those with a taxable turnover above £90,000 (VAT threshold 2025/26) are legally obligated to get registered. Smaller companies sometimes choose to register voluntarily, especially if it benefits their operations.

When your business charges VAT on goods or services, this number confirms you're authorised to collect VAT for the government. It also allows your business to reclaim VAT paid on purchases from other businesses, which can help reduce your overall tax liability.

For your clients and businesses, a VAT number on an invoice offers extra confidence. It helps verify that the VAT being charged is legitimate and can be reclaimed if appropriate. Without it, you risk paying VAT you can’t reclaim or dealing with suppliers who aren’t properly registered. In short, a VAT number is a key marker of professionalism and compliance in the UK business landscape.

Key Functions of Your VAT Number

Your VAT number is used to:

- Identify your business in HMRC's VAT system

- Track VAT you collect from customers

- Monitor VAT you pay to suppliers

- Process VAT returns and payments

- Verify your business's VAT registration status

- Enable VAT reclaims on business purchases

Standard UK VAT Number Format

UK VAT numbers follow a standardised format that makes them easy to identify and validate. It typically consists of two letters followed by nine digits. Here's a breakdown of what a typical VAT number looks like:

- Two Letters: The VAT number starts with "GB," which indicates that the business is registered in the United Kingdom.

- Nine Digits: After the letters, there are nine numbers. These numbers are unique to your business.

For example, a UK VAT number might look like GB123456789 on legitimate invoices. If you’re dealing with international suppliers or clients, their VAT numbers might look different, but the underlying purpose is the same, it’s proof that the business is authorised to deal with VAT.

Why Do You Need to Find a Company’s VAT Number?

Making sure a company’s VAT number is legitimate isn’t just a formality, it’s a critical safeguard for your business and your cashflow.

1. To Verify supplier legitimacy

When you engage with a supplier, you need certainty that they’re authorised to charge VAT. A valid VAT number is proof they’re registered with HMRC and legally entitled to collect VAT. This reassures you that their invoices are compliant, and any VAT paid is properly recorded.

2. To Avoid fraudulent invoices

Unfortunately, fraudulent or misleading invoices with VAT charges do circulate, sometimes issued by companies that aren’t even registered. By checking the VAT number, you can identify inconsistencies early. If the number is invalid or doesn’t correspond to the business, it’s a clear warning sign.

3. To claim input VAT on business expenses

If your business is VAT-registered, you’re entitled to reclaim VAT paid on eligible expenses. HMRC, however, only permits this if the supplier’s invoice displays a valid VAT number. Failing to confirm this can result in losing out on VAT refunds you’re otherwise entitled to.

4. For Cross-border trade compliance (EU/International)

For businesses engaged in EU or international trade, VAT checks become even more critical. Systems like the VIES (VAT Information Exchange System) allow you to validate EU VAT numbers, helping you avoid errors in tax treatment on cross-border sales and ensuring your business remains compliant with international trade rules.

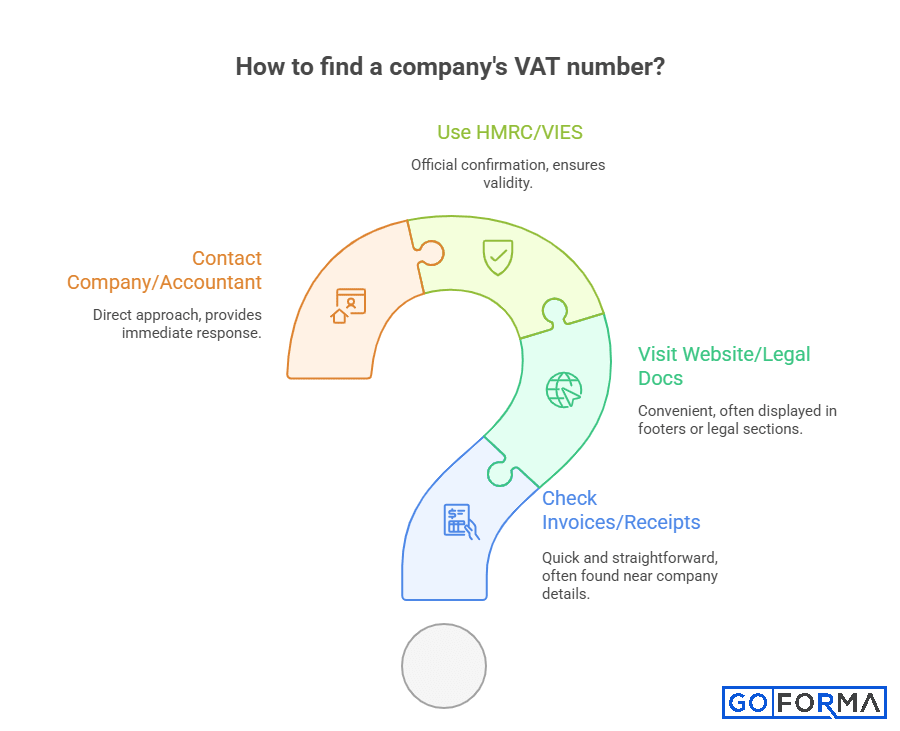

4 Places to Find VAT Number for a Company

Sometimes you need to verify a supplier's or customer's VAT number for business transactions or VAT reclaims. Use below methods to find another company's VAT number.

1. Check the Company's Invoices or Receipts

A VAT-registered company is required to list its VAT number on invoices and receipts.

Typically, you’ll find this number near the company name, address, or registration details. It can also appear in the receipt alongside the tax summary. If you can’t spot it, double-check the small print, as some businesses include it in the footer.

2. Visit the Company's Website & Check Legal Documents

Many businesses display their VAT number on their official website. Check the footer, contact page, or the terms and conditions. For online transactions, you might see it at checkout or in confirmation emails.

Apart from the website, VAT numbers often appear on legal documents such as contracts, letterheads, or formal notices. If you’re already working with the company, these documents should be readily available and provide a clear reference.

3. HMRC Check VAT Number Service or VIES Database

For official confirmation, you can use online tools provided by tax authorities.

HMRC VAT Checker (UK):

You can use the government’s Check a UK VAT Number service to search for a company's VAT number. This allows you to check whether a UK VAT number is valid and linked to the right business details.

VIES Database (EU):

If you’re trading with companies in the EU, the VAT Information Exchange System (VIES) helps you confirm EU VAT numbers.

Both resources are free and offer assurance that the VAT number is legitimate and active, particularly useful when working with new or international partners.

4. Contact the Company or Accountant

If you’re unable to locate the VAT number through the above methods, the direct approach is often the simplest. Reach out to the company’s accounts team or accountant and request the VAT number.

Legitimate businesses will provide it without hesitation. If a company is unwilling to share this information or avoids your request, that could indicate they’re not VAT-registered or may not be fully compliant.

Finding Your Business VAT Number

If you’re operating a VAT-registered business in the UK, that VAT number is pretty much your lifeline for anything official. It’s the unique identifier HMRC hands out once you’re registered, and you’ll be quoting it on your invoices, tax returns, and just about any official paperwork that crosses your desk.

Not everyone has their paperwork perfectly filed away, or let’s be honest, you can’t find it on your records, or simply aren’t sure where to check. Don’t stress. Tracking down your VAT number is usually easy, and there are multiple places it might be listed.

Let me show you exactly where to look, how to recover it if it’s missing, and what to do if you need to check whether a VAT number is valid. Keep reading and you’ll know exactly how to find your VAT number in just a few simple steps.

Why does Your Business Need VAT Registration Number?

1. To File VAT Returns

Your VAT number is essential for filing a VAT return with HMRC. Every time you report how much VAT you’ve collected from customers and paid to suppliers, HMRC uses your VAT number to track payments and confirm you’re following UK tax rules.

2. Mandatory Display on Business Invoices

UK law says VAT-registered businesses must display their VAT number on every invoice sent out. This rule, set out in HMRC VAT Notice 700, is there for transparency, and so HMRC can check you’re compliant with tax collection.

3. To Use in Business Transactions and Communications

You’ll find your VAT number requested in all sorts of business dealings. Suppliers often ask for it before they process your orders or set up credit terms, since it lets them verify your business status right away. Including your VAT number on purchase orders, contracts, and official communications shows professionalism and helps keep transactions moving smoothly.

4. To Claim VAT Refunds and Credits

One of the practical benefits to VAT registration is reclaiming VAT on business expenses. To do this, you’ll need your VAT number on all the relevant forms and supporting documents. Managing this through your VAT returns can really help cut down your business’s operating costs.

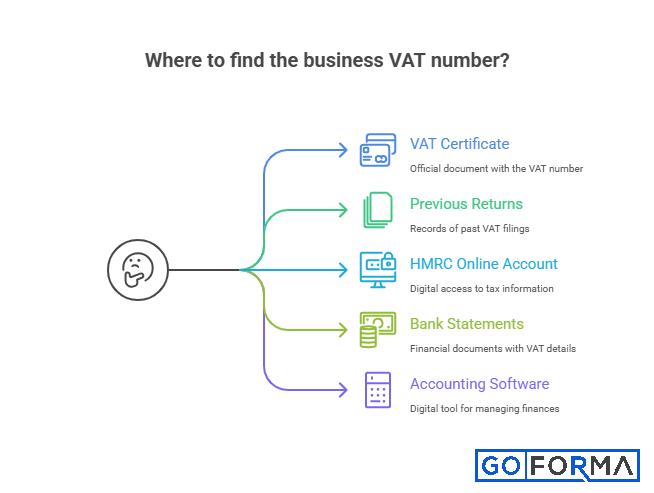

How to Find Your Business VAT Number

There are 5 places where you can find your Company's VAT Registration Number:

1. VAT registration certificate

2. Previous VAT returns

3. HMRC Online Account (Government Gateway)

4. Business Bank Statements & Letters from HMRC

5. Accounting Software

To find your company's VAT number, you can check below:

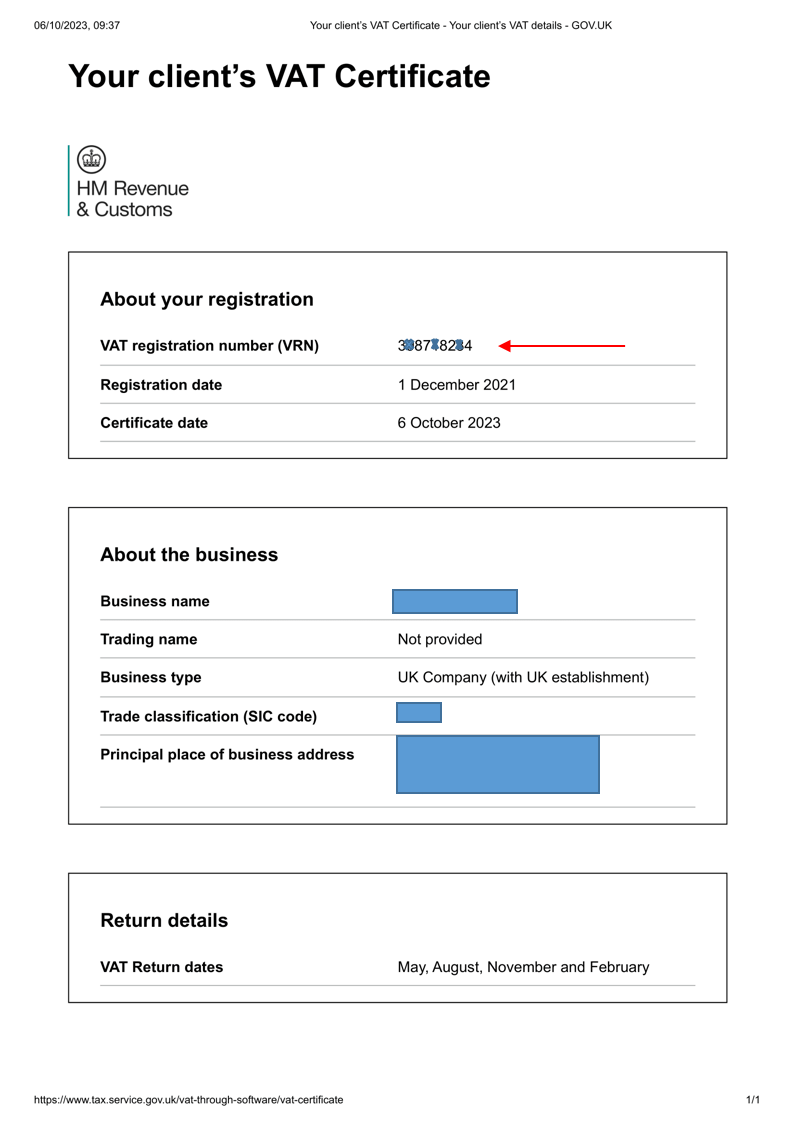

1. ⚡ FASTEST: Check Your VAT Registration Certificate

⏱️ Time: 5 seconds

📊 Success Rate: 95% (if certificate is accessible)

🎯 Difficulty: Very Easy

What is a VAT Certificate?

A VAT certificate, in short, is the official confirmation you get from HMRC when your VAT registration goes through. They issue a VAT registration certificate, also called Form VAT4, which includes your VAT number, the date your registration becomes effective, and other relevant details.

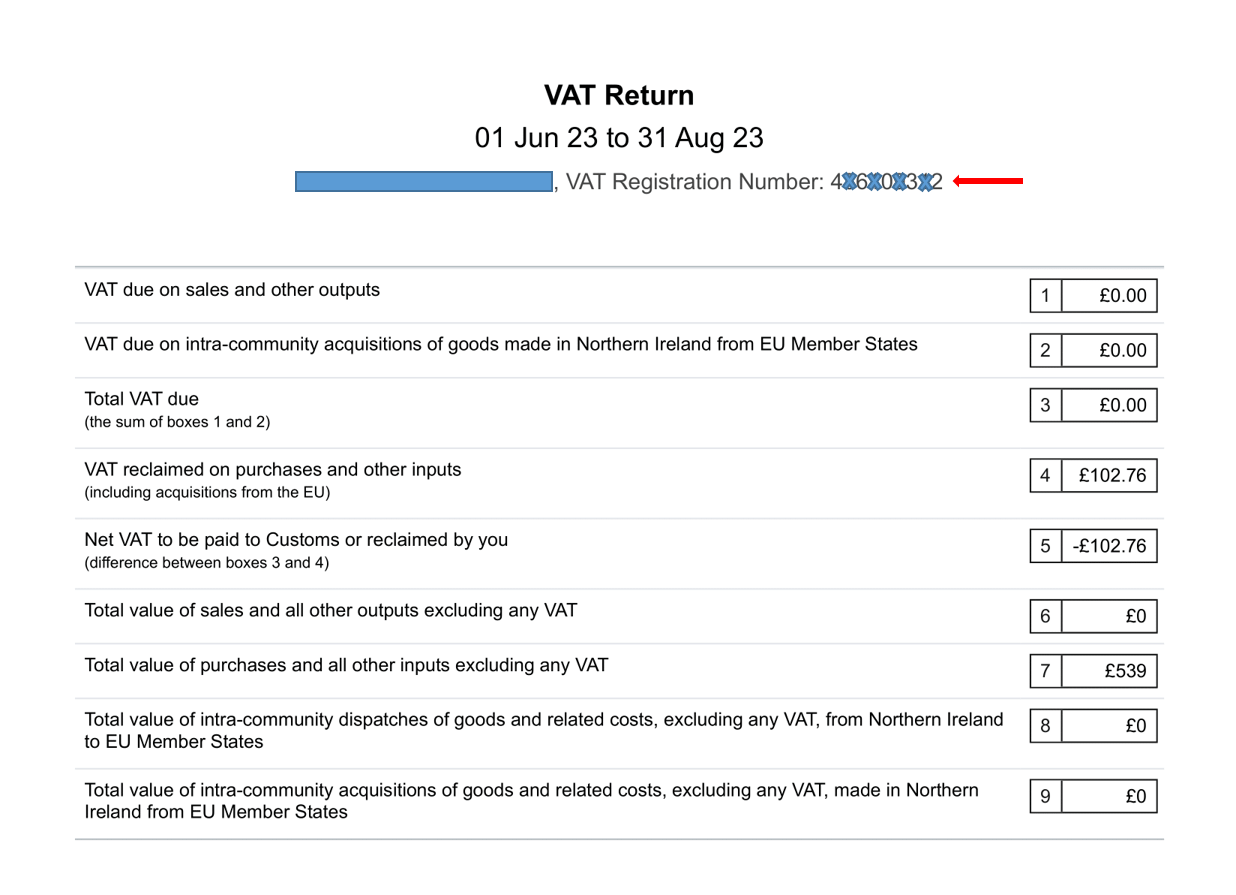

2. Check Previous VAT Returns

⏱️ Time: 2-5 minutes

📊 Success Rate: 90%

🎯 Difficulty: Easy to Medium

If you don’t have your VAT registration certificate handy, don’t stress. Just refer to one of your previous VAT returns. Every VAT return you submit to HMRC includes your VAT number as a primary identifier. Whether you file monthly, quarterly, or annually, your VAT number appears on Form.

3. Check Your HMRC Online Account (Government Gateway)

If you have access to your Government Gateway account, you can easily find your VAT number online. Here’s a quick way to do it:

- Visit the Government Gateway login page.

- Sign in using your user ID and password.

- Go to the “VAT” section of your account.

- Your VAT number will be shown within your VAT account details.

This is especially handy if you’ve misplaced your registration certificate or need your VAT number in a hurry while you’re working remotely. No need to waste time searching through paperwork, your VAT number is right there in your online account.

4. Check Business Bank Statements & Letters from HMRC

At times, HMRC will include your VAT number in the official correspondence they send, like VAT return and payment reminders, or updates on your VAT account. It’s also smart to review your business bank statements. Any transactions or payments involving HMRC and VAT might show your VAT number in the payment reference.

5. 🖥️ QUICK: Check Your Accounting Software

⏱️ Time: 1-2 minutes

📊 Success Rate: 85%

🎯 Difficulty: Easy

These days, most accounting software will store your VAT number in your business settings once you enter it during setup. That makes things a lot easier, especially if you use accounting software regularly for invoicing or bookkeeping. For example, the image below shows the VAT number in FreeAgent accounting software.

What if I Lost My VAT Number?

It’s not unusual for business owners to misplace their VAT number or forget where it’s stored. The good news is that there are simple ways to recover it if you can’t spot it in the usual places.

1. Contact HMRC

⏱️ Time: Immediate on phone | 2-5 working days via email

📊 Success Rate: 100%

🎯 Difficulty: Medium

If you’ve checked your paperwork and still can’t find your VAT number, you can contact HMRC for assistance.

Phone (Fastest):

- UK: 0300 200 3700

- International: +44 2920 501 261

- Textphone: 0300 200 3719

- Opening Hours: Monday-Friday, 8am-6pm (closed bank holidays)

- Average Wait Time: 5-10 minutes

Email:

- Address: vatgeneralenquiries@hmrc.gov.uk

- Response Time: 3-5 working days

- Note: Include business details in subject line

Online Chat:

- Access: https://www.tax.service.gov.uk/ask-hmrc/chat/vat-online

- Available: Monday-Friday, 8am-6pm

- Average Response: 10-15 minutes during chat

Postal Address (Slowest):

HM Revenue and Customs

BX9 1WR

United Kingdom

Response time: 15-20 working days

⏱️ Best Times to Call: Tuesday-Thursday mornings (9-11am) typically have shortest wait times. Avoid Monday mornings, month-end, and January (busiest periods).

Information to Have Ready Before Calling

HMRC will need to verify your identity and business details. Gather these before calling:

Essential Information:

- Unique Taxpayer Reference (UTR) - 10 digit number

- Company registration number (if limited company)

- Registered business address including postcode

- Business postcode

- Approximate VAT registration date (month/year is fine)

2. Ask Your Accountant

If you work with a small business accountant or bookkeeper, they will almost certainly have your VAT number on record. Since they handle your VAT returns and other financial paperwork, they can provide it quickly. This is often the easiest route if you already share your financial records with them.

How to Check If a VAT Number is Valid

Once you’ve got a VAT number in hand, verifying that it’s both authentic and currently active is really very important. Using an incorrect or invalid VAT number can cause problems for your business, especially if you’re reclaiming VAT. Thankfully, there are simple tools available to check validity.

1. For UK Businesses - Use HMRC’s VAT Checker

- Tool: Online VAT number checker

- Website: https://www.gov.uk/check-uk-vat-number

- Information provided: Validity, business name, address

- Update frequency: Updated within 72 hours of registration

- Cost: Free

2. For EU VAT Numbers - Use VIES (VAT Information Exchange System):

- System: VAT Information Exchange System

- Website: https://ec.europa.eu/taxation_customs/vies/#/vat-validation

- Information provided: Validity, business name, address

- Update frequency: Real-time

- Cost: Free

Your Easy Next Steps for VAT Success

Finding a company's VAT number is typically pretty simple once you know where to check. You’ll find it on your VAT registration certificate, VAT returns, or in your HMRC online account. Still can’t find it? Just give HMRC a call or reach out to your accountant, they’ll have it handy. No need to stress.

If VAT still feels complicated, or you’re not totally sure about your responsibilities or how to handle the paperwork, it’s worth bringing in a small business accountant. They’ll handle the registration process, sort out your returns, and make sure you stay compliant.

Ready to take the stress out of VAT and accounting? Book a free consultation with our accountant today to discuss your VAT requirements and how to get the most out of it.

FAQs on Finding VAT Number in UK

What is the VAT Registration Threshold 2025/26?

The VAT registration threshold for the tax year 2025/26 is £90,000.

How Many Digits is a Company VAT Number?

A UK VAT number consists of 9 digits, usually starting with the country code (e.g., "GB") followed by the 9 digits unique to your business.

What does a VAT number look like in the UK?

A UK VAT number starts with “GB” followed by nine digits, for example GB123456789.

Are the Company Number and VAT Registration Number the Same?

No, the company number and VAT number are not the same. The company number is a separate registration assigned by Companies House, while the VAT number is issued by HMRC for VAT-related transactions. Each serves a distinct purpose in business operations.

Is my UTR my VAT number?

No, your UTR is not your VAT number. A UTR (Unique Taxpayer Reference) is used while paying your personal tax, while a VAT number is for VAT-registered businesses used to manage VAT submissions and payments.

Does every business have a VAT number?

No, not every business has a VAT number. Only VAT registered businesses, typically earning over the VAT threshold (£90,000), have one.

Do I have to pay for a VAT number?

No, registering for a VAT number with HMRC is free.

Is my VAT number on Companies House?

No, Companies House does not list VAT numbers. It only records company registration details.

What If I'm Registered for Multiple VAT Schemes?

You have ONE VAT number regardless of VAT scheme.

Do I Need Different VAT Numbers for Online and Physical Stores?

No. One business = one VAT number, regardless of sales channels.

Can I check a company’s VAT number online for free?

Yes, you can use HMRC’s VAT checker or the EU VIES tool to confirm a business’s VAT number.

Do sole traders have VAT numbers?

Only if they register for VAT. Being a sole trader does not automatically give you one.

How long does it take to get one after applying?

It usually takes around 2–4 weeks, though sometimes it can be quicker or longer depending on HMRC’s processing.

Where can I find a company’s VAT number?

You can check invoices, receipts, the company’s website, business directories, or use HMRC’s VAT number checker.

Sources & Verification

This article references official HMRC guidance and UK legislation:

Primary sources:

- VAT Act 1994 - Legal framework for VAT in UK

- HMRC VAT Notice 700: The VAT Guide - Comprehensive VAT guidance

- HMRC VAT Registration Service - Official registration portal

- HMRC VAT Number Checker - Validation tool

Additional resources:

⚠️ IMPORTANT TAX NOTICE

This guide provides general information about finding VAT numbers in the UK. Tax situations vary significantly between businesses. For specific advice about your VAT obligations, consult a qualified accountant or tax advisor. This article does not constitute professional tax advice.

.png)