Who Needs a UTR Number?

Who Needs a Personal UTR Number?

You’ll need a personal UTR number if you are:

- Self-employed or a sole trader

- A partner in a business partnership

- Earning income from investments, rental properties, or overseas income

- Filing a Self Assessment for any other reason, such as claiming child benefit when your income exceeds a certain threshold

Who Needs a Company UTR Number?

Your company will need a UTR number if it is:

- A limited company

- A partnership (each partner will also need a personal UTR)

- A non-profit organization, like a charity, that is registered as a company

- A company registered in the UK that pays Corporation Tax

Personal UTR number vs Company UTR

Both individuals and companies in the UK have Unique Taxpayer Reference (UTR) numbers, but these two types of UTRs serve different purposes.

Personal UTR:

Personal UTRs are automatically issued by HMRC to anybody who registers for self-assessment. If you're self-employed, earn income outside of regular employment, or have other sources of untaxed income, HMRC issues you a personal UTR number. This number is used to identify you when you file your taxes, pay your tax bill, or communicate with HMRC about your personal tax affairs.

Company UTR:

A company UTR is assigned to a registered business rather than an individual. When you incorporate a company in the UK, HMRC automatically issues your business with a company UTR number. This number is used for Corporation Tax purposes, allowing HMRC to track your company’s tax payments, filings, and any correspondence related to the business's tax matters.

Why Do I Need a UTR Number?

If you're self-employed, running a limited company, or earning income that isn't taxed through PAYE (Pay As You Earn), you'll need a Unique Taxpayer Reference (UTR) number. Here's why it's essential:

1. Registering as Self-Employed

When you start working for yourself, you must register as self-employed with HMRC. During this registration, HMRC will issue you a UTR number. This number will be used in all your tax-related correspondence and is crucial for managing your tax affairs.

2. Filing Self Assessment Tax Returns

One of the primary reasons you need a UTR number is to file your Self Assessment tax returns. If you're self-employed or earn income outside of regular employment, HMRC requires you to report your income and expenses through a Self Assessment. Without a UTR number, you can't complete this process, which could lead to penalties for late filing.

3. Paying Your Taxes

Your UTR number links to your tax records, making it easier for HMRC to track your tax payments. When you pay your taxes, you'll need to include your UTR number to ensure that your payment is correctly credited to your account.

4. Dealing with HMRC

Whenever you need to contact HMRC regarding your tax affairs, they'll ask for your UTR number. Whether you're querying a tax bill, updating your details, or discussing your tax payments, your UTR number will help HMRC quickly locate your records.

5. Proving Your Self-Employed Status

Your UTR number can also serve as proof of your self-employed status. If you apply for a mortgage, loan, or certain benefits, you may need to provide your UTR number to verify your income and employment status.

6. Dealing with Accountants

When working with an accountant to manage your tax affairs, your UTR number is essential. Accountants use your UTR number to access your tax records, file your Self Assessment tax returns, and ensure your taxes are calculated and paid correctly. Providing your accountant with your UTR number allows them to get in touch directly with HMRC on your behalf, making the tax process smoother and more efficient.

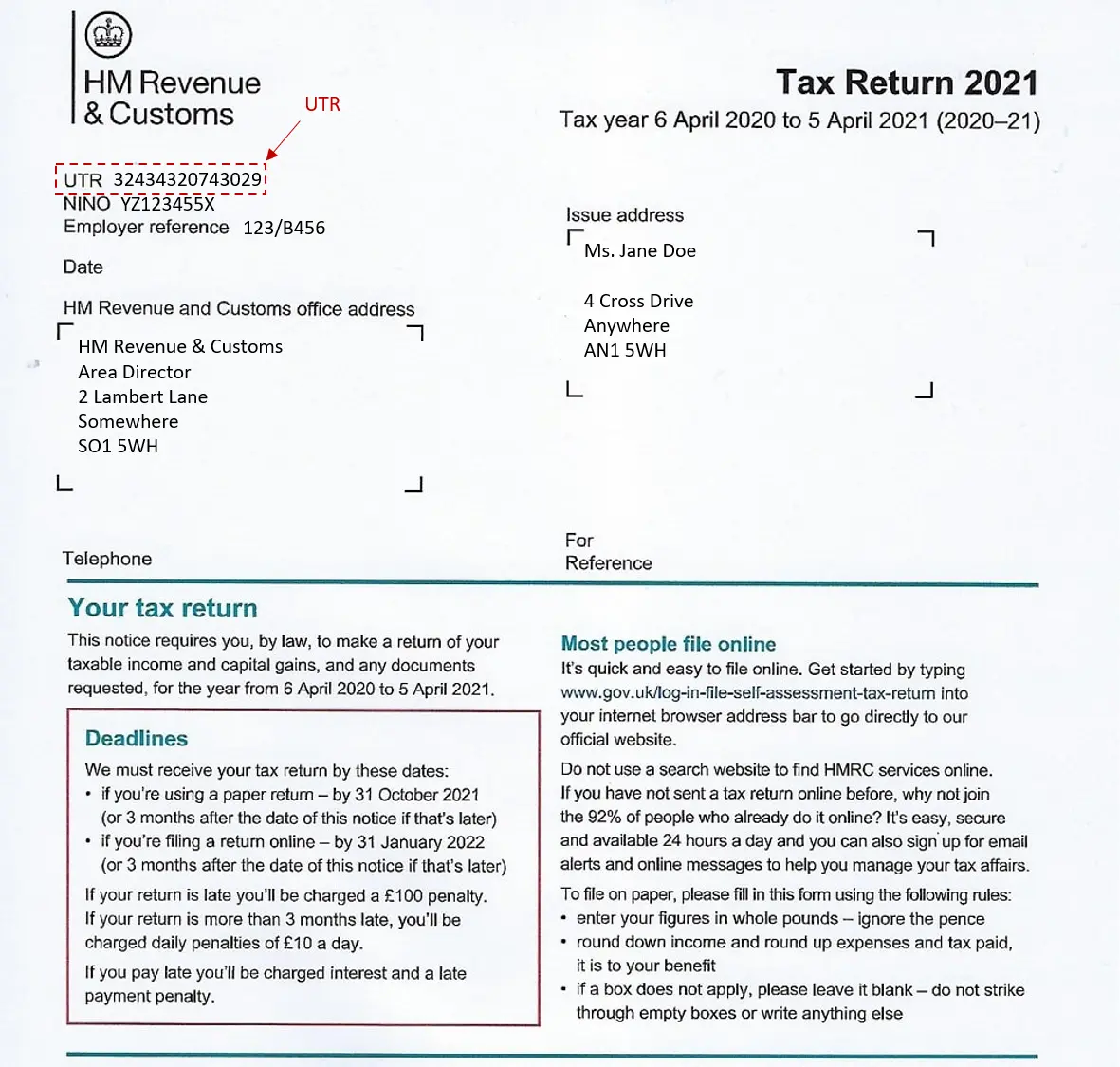

Where can I Find My UTR Number?

You can find your UTR number in a variety of ways, provided you've already got one.

It should be easy to identify thanks to its length; your UTR can be easily located on numerous documents from HMRC, including:

1. Previous tax returns

2. Payment reminders

3. Notices to file tax returns

4. Statements of account

5. The "Welcome to self-assessment" letter (SA250)

6. HMRC App

Your UTR number can also be found online in your Government Gateway account. It's located in the top right-hand corner of your account summary.

How to Apply for UTR Number from HRMC?

When you set up a limited company or get set up for self-assessment tax returns, you automatically undergo the UTR registration process.

You'll automatically receive a UTR number after the process is complete. Keep in mind that it can take some time to receive your number - it's best to apply a few months in advance of when you'll need your UTR number to ensure things go smoothly.

Information Required to Register for Unique Taxpayer Reference:

- Your full name

- Your current address

- Your National Insurance Number

- Your date of birth

- Your phone number

- Your email address

- The date that your self-employment began

- The type of business you're starting

- The address of your business

- The phone number for your business

It's easy to apply for your Free UTR number and - provided you've got all of the necessary information on hand - easy. You can notify HMRC online or print and fill out a form before posting it to them.

Protecting Your UTR Number

- Keep your UTR confidential: Your Unique Taxpayer Reference (UTR) is a sensitive and personal identifier that should be treated with utmost confidentiality. Here are some key points to consider:

- Do not share your UTR number with unauthorized individuals or parties.

- Avoid including your Unique taxpayer reference number in public documents, emails, or online platforms.

- Only provide your UTR when required by trusted entities, such as HMRC and authorized tax advisors.

- Be cautious about sharing your UTR over the phone, ensuring you are speaking with a legitimate representative from HMRC or a trusted organization. - Secure storage of tax-related documents: In addition to protecting your UTR, it is essential to ensure the secure storage of your tax-related documents. Here are some tips to safeguard your tax records:

- Keep physical copies of documents in a secure location, such as a locked cabinet or safe.

- Store electronic copies of documents in encrypted and password-protected folders or cloud storage services.

- Regularly back up your electronic files to prevent data loss.

- Dispose of tax documents properly by shredding physical copies and securely deleting electronic files that are no longer needed. - Being cautious of phishing attempts: Phishing is a fraudulent technique used by cybercriminals to obtain sensitive information, such as UTRs, passwords, or financial details. To protect yourself from phishing attempts:

- Be skeptical of unsolicited emails, text messages, or phone calls asking for your UTR or other personal information.

- Verify the legitimacy of the communication by independently contacting the purported sender through official channels (e.g., HMRC's official website or contact information).

- Do not click on suspicious links or download attachments from unknown sources.

- Keep your computer and other devices protected with up-to-date security software and firewalls.

By following these measures to keep your UTR confidential, securely storing your tax-related documents, and being cautious of phishing attempts, you can minimize the risk of unauthorized access to your tax information and protect yourself against potential fraud or identity theft.

How can I Find a Lost UTR Number?

Those who've lost their UTR numbers should act quickly to rectify the situation. You can find steps on how to find lost UTR numbers here.

When it comes to taxes and the government, it's always best to have your ducks in a row before deadlines start approaching. Try to have your National Insurance number at the ready and then ring HMRC's self-assessment helpline at 0300 200 3310.

For any general enquiries, you can reach out to HMRC Helpline numbers during their working days.

Telephone: 0300 200 3310

Outside UK: +44 161 931 9070

Opening times:

8am to 8pm, Monday to Friday

8am to 4pm Saturday

9am to 5pm Sunday

Does My UTR Number Change if I Acquire a Company?

If you purchase a company and continue to trade under the same company number then the UTR doesn't change.

If the assets and liabilities of the company are being transferred to the acquiring company (effectively meaning it's no longer trading as the same entity), then the acquiring company's UTR number will apply.

How to Apply for a UTR Number UK

Don't Miss Out on Tax Benefits! Contact us today to apply for Your UTR Number. From seamless application to hassle-free processing, our expert team is here to ensure you get your UTR number swiftly and accurately. Say goodbye to tax confusion and hello to peace of mind. Join countless satisfied clients who have entrusted us with their tax needs.

Need Help with Your Taxes?

Struggling with taxes? Whether it’s filing returns, maximizing deductions, or resolving tax issues, we’ve got you covered. We have a team of expert London accountants to help individuals, small businesses, and contractors handle the complex world of taxes. Get personalized, stress-free support today, and take the guesswork out of managing your taxes. Book a free consultation now to get started!

Frequently Asked Questions on UTR Number

Do I need a UTR number to submit my return?

Yes, you need a Unique taxpayer reference number to complete your self-assessment tax return successfully. If you’re self employed, or you own a limited company, you need a UTR number.

How long does it take to get a UTR number?

After registering for self-assessment, you should receive your UTR number in 10 working days or 21 working days if you're abroad.

How much does it cost to apply for a UTR number?

Applying for a UTR number is free of charge. There are no costs associated with obtaining or using your UTR number from HMRC.

Can I change my UTR?

No, you cannot change your UTR number. Once issued, it remains the same for your entire lifetime.

Is a UTR number the same as a tax code?

No, a UTR number is not the same as a tax code. A UTR number is a unique identifier used to manage your tax records with HMRC, while a tax code helps determine the amount of income tax you should pay on your earnings.

Do I need a UTR number as a Sole Trader?

Yes, as a sole trader, you need a UTR number. It is essential for filing your self-assessment tax returns and managing your tax affairs with HMRC.

Will my UTR number appear on my P45?

UTR numbers are not typically required for individuals who work for an employer and pay tax through the PAYE system. The P45 form you receive when leaving a job includes your National Insurance number, your employer's PAYE reference number, and your tax code, but not your UTR number. UTR numbers are mainly needed for those who are self-employed, company directors, or involved in other taxable activities outside of PAYE.

Do company directors have UTR numbers?

Yes, company directors do have UTR numbers. As a director, you need a UTR number for filing your personal self-assessment tax returns and managing your tax affairs with HMRC.

.png)