What is P11D?

The P11D is the official HMRC form reference (Form P11D - Expenses and Benefits) used to declare the cash value of benefits in kind provided by UK employers to their workforce. It records employment benefits that the employees and directors of a company have received across the year.

P11D form is a declaration that employers must submit to HMRC annually. It reports the value of any benefits and expenses provided to employees that aren't included in their salary. These benefits might include things like company cars, private health insurance, and interest-free loans.

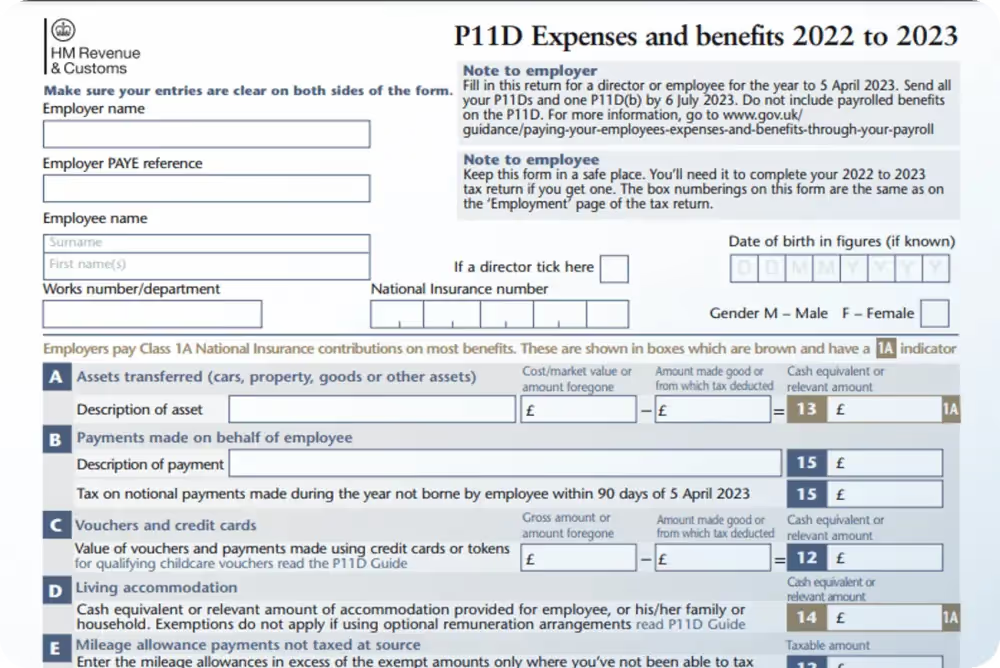

Each P11D form includes your basic identifying information, along with various sections that cover a range of benefits and expenses-from accommodation, to vouchers, credit cards and mileage allowance.

Accurate completion of the P11D form is essential to calculate the correct tax liability for both employers and employees. It must be filed by July 6th of each tax year and is a crucial part of payroll and tax returns. Employers can submit the P11D form online through HMRC's PAYE online service or utilising third-party software.

Who Must File a P11D?

UK employers must file individual P11D forms for:

- All company directors (regardless of earnings)

- Employees receiving taxable benefits beyond their regular salary

- Part-time and temporary staff who receive benefits

- Sole directors of limited companies (acting as both employer and employee)

Exception: Sole traders and partnerships without employees don't need to file P11D forms, as expenses are reported through self-assessment tax returns instead.

What Benefits Must Be Reported on P11D?

The P11D form is the go-to document for reporting "benefits in kind," which are essentially the extra benefits employees get on top of their salary.

The information typically includes details about expenses or benefits such as:

Vehicle Benefits:

- Company cars and fuel

- Car parking spaces

- Company vans for personal use

Insurance and Healthcare:

- Private medical insurance

- Health screenings and gym memberships

- Life insurance policies

Financial Benefits:

- Interest-free or low-interest loans over £10,000

- Credit cards for personal expenses

- Cash vouchers and non-cash vouchers

Property and Assets:

- Living accommodation provided by employer

- Use of company assets (phones, computers for personal use)

- Assets transferred to employees

Other Perks:

- Non-business travel and entertainment

- Professional subscriptions paid by employer

- Childcare vouchers (in some cases)

Sample P11D Form

Below is the sample of how P11D form looks like:

What NOT to Include on P11D

Since April 2016, genuine business expenses are exempt from P11D reporting. These include:

- Business travel and accommodation

- Business entertainment expenses

- Professional fees and subscriptions (required for work)

- Work uniforms and tools

- Mobile phone bills (for work purposes)

- Mileage allowance at HMRC-approved rates

How to Submit P11D Forms

Employers can file P11D forms through:

- HMRC PAYE Online Service (for businesses with up to 500 employees)

- Compatible payroll software (automatic filing)

- Third-party payroll providers (outsourced submission)

P11D Deadline

The P11D form must be submitted by July 6th each tax year to avoid penalties. For the tax year 2025/26, the P11D deadline is July 6, 2026. This deadline covers benefits and expenses provided to employees during the previous tax year, which runs from April 6th to April 5th. The submission can be done online, or using third-party payroll software. It serves as the basis for payrolling benefits or filing the P11D(b) form.

| What you need to do | Deadline after the end of the tax year |

|---|---|

| Report expenses and benefits | 6 July |

| Give your employees a copy of the information | 6 July |

| Report the total Class 1A National Insurance you owe | 6 July |

| Pay Class 1A National Insurance | 22 July (19 July if paying by cheque) |

| Pay tax and Class 1B National Insurance if you have a PAYE Settlement Agreement | 22 October (19 October if paying by cheque) |

| Pay PAYE tax or Class 1 National Insurance if ‘payrolling’ | Monthly through payroll |

P11D Late Filing Penalties

- If you submit your P11D form late, there’s a penalty of £100 for every 50 employees for each full month it’s overdue.

- For late National Insurance Contributions (NICs), a 5% penalty applies if payment is more than 30 days late. This penalty rises to 10% after 6 months and goes up to 15% after 12 months, with interest charged on the outstanding amount.

Penalties can also be issued if inaccurate information is provided on your tax return, whether due to carelessness or deliberate action. This may result in:

- underpaying taxes

- over-claiming tax reliefs

P11D(b) Form: The Companion Declaration

What is P11D(b) Form?

The P11D(b) form accompanies your P11D submissions and calculates the total Class 1A National Insurance Contributions due on all employee benefits provided throughout the tax year.

When You Must Submit P11D(b):

- You've submitted any P11D forms

- You've payrolled employee benefits and expenses

- HMRC has specifically requested it

One P11D(b) covers your entire company, summarising all benefits across all employees, whereas individual P11D forms are needed for each employee.

Do I Need to Give Employees a Copy of Their P11D?

Yes, by law, employers must provide each employee with a copy of their P11D form by July 6th. Employees need this information to:

- Complete their self-assessment tax return accurately

- Verify the benefits reported match what they received

- Request corrections if information is inaccurate

- Claim tax repayments if applicable

Employees can also request copies directly from HMRC if their employer doesn't provide them.

Alternatives to P11D Filing

Payrolling Benefits

Instead of filing P11D forms annually, employers can payroll benefits by:

- Registering benefits with HMRC before April 6 (start of tax year)

- Including benefit values in employees' regular payroll

- Deducting tax monthly through PAYE system

- Providing benefits statements to employees by June 1

Important: Even when payrolling benefits, you still must submit P11D(b) to report Class 1A NICs.

PAYE Settlement Agreements (PSAs)

For minor, irregular, or impractical benefits, employers can arrange a PSA with HMRC to:

- Make one annual payment covering all tax and NICs

- Avoid processing items through payroll

- Skip P11D forms for covered items

- Pay Class 1B (not 1A) National Insurance instead

Suitable for: Small gifts, staff entertaining, shared company assets.

Differences Between P11D and P11D(b) Forms

The main difference between the P11D and P11D(b) forms is their purpose. The P11D form is used to report employee benefits, while the P11D(b) form is used to account for tax. Additionally, the filing deadline for both forms is July 6th. The P11D form is necessary when benefits are not payrolled, whereas the P11D(b) form is required when benefits are payrolled. Furthermore, the P11D form is employee-specific, while the P11D(b) form is company-wide.

|

Aspect |

P11D Form |

P11D(b) Form |

|

Submission Purpose |

Reports individual employee benefits and expenses. |

Summarizes the total Class 1A National Insurance contributions due on benefits and expenses reported in P11D forms. |

|

Submission Frequency |

Filed separately for each relevant employee who received benefits-in-kind (annually). |

Filed alongside P11D forms, summarizing Class 1A National Insurance contributions (annually). |

|

Responsibility |

Employer's responsibility to submit on behalf of individual employees. |

Employer's responsibility to submit for the entire organization. |

|

Details Included |

Specific details of individual employee benefits and expenses, including calculations. |

Aggregated summary of Class 1A National Insurance contributions, not individual employee details. |

|

Electronic Filing Option |

Available for both online and paper submission. |

Usually submitted online for efficiency. |

|

Submission Deadline |

Generally due by July 6th following the end of the tax year. |

Same deadline as P11D forms, typically by July 6th. |

|

Main Purpose |

Determines the taxable value of benefits provided to employees. |

Calculates Class 1A National Insurance contributions owed by the employer. |

Get Help with Your P11D Forms

When to Seek Professional Advice:

- First-time employers unsure what to report

- Complex benefit calculations (company cars, living accommodation)

- Multiple employees with varied benefits

- Previous filing errors needing correction

- Considering switching to payrolling benefits

GoForma's small business accountants can help with P11D preparation, submission, and ongoing compliance, ensuring you meet all deadlines and avoid penalties.

FAQs on P11D

When is P11D due?

The deadline for submitting the annual P11D and P11D(b) forms to HMRC is typically on July 6th following the end of the tax year. For the tax year 2025/26, the P11D deadline is July 6, 2026.

What if I have No BiKs or Expenses to Report?

Even if you have no benefits in kind or expenses to report, you must still submit a 'nil return' P11D form. This maintains compliance with HMRC regulations and avoids potential penalties.

Who needs to file a P11D?

To comply with tax regulations, your company must fill out and submit a P11D form separately for every "relevant employee" or company director who has received benefits-in-kind in addition to their regular salary during the fiscal year. The obligation to complete and file a P11D form lies with the employer, and it is not the responsibility of the employee.

When should my employer give me my P11D?

Your employer should provide you with your P11D form by July 6th each year. Keep this document safe as you may need it to complete a self-assessment tax return or claim a tax repayment.

Does P11D affect my tax code?

Yes, the information on your P11D form can affect your tax code. The amount reported on the P11D form represents additional employment income in the form of taxable benefits and expenses which HMRC uses to adjust your tax code accordingly for accurate tax deductions from your salary.

Can I file P11D electronically?

Yes, HMRC requires electronic filing for P11D forms. Use HMRC's PAYE Online service, compatible commercial software, or a payroll provider. Paper forms are only accepted in exceptional circumstances.

What's the difference between P11D and P11D(b)?

P11D reports individual employee benefits (one per employee). P11D(b) calculates total Class 1A National Insurance for all benefits company-wide (one per company). Both are due July 6th.

Do sole traders need to file P11D?

No, sole traders report their business expenses through self-assessment tax returns instead. P11D forms only apply to employers providing benefits to employees.

.png)