Welcome to GoForma, your trusted source for comprehensive insights into the best business bank accounts in the UK. Choosing the right business bank account is a crucial decision for any entrepreneur. In this guide, we will walk you through the essential aspects of business banking, compare top contenders like Tide, Revolut, Starling, and Metro, and help you make an informed choice that aligns with your business needs.

We road tested the best business bank accounts out there so you do not have to.

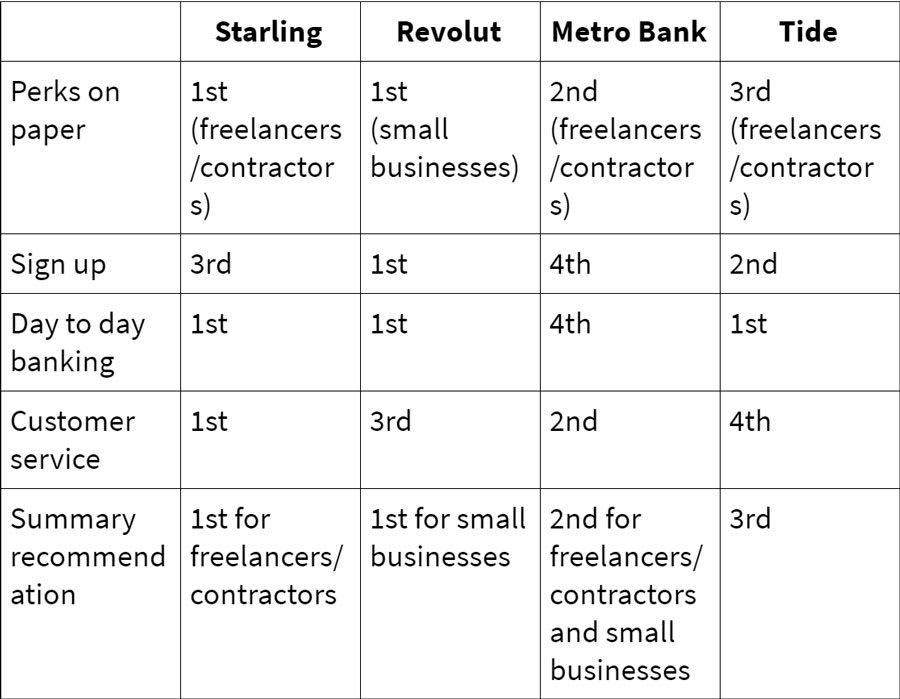

Starting with the four contenders with the best features and costs on paper, we put them through their paces testing usability, ease of sign-up, response times and the day to day banking experience.

The full details are below, so you can experience what each one is like from the inside, without having to go to all the trouble of opening accounts with each of them.

BVA BDRC, a reputable consumer insight consultancy, consistently conducts an independent survey for the Competition and Markets Authority (CMA). The objective of this survey is to determine the likelihood of recommendation among individuals who have a business bank account. Approximately 18000 small business banking customers were surveyed for 15 banks between the time span of July 2022 and June 2023. We have leveraged the this data to compare the listed banks in our article.

It's a long article, so let's get to the conclusion and summary first for those who just want to see the results.

Conclusion

At the end of the day, different businesses have different needs and there isn't a one-size-fits-all business bank account.

Freelancers and contractors have two strong options when it comes to business bank accounts: I personally recommend you to go with Starling given its ease of use and low fees. You can get an even faster onboarding time by using this link.

However if you are more of a traditionalist and like the support that a physical branch provides, go with Metro Bank.

For a small business, Revolut is the clear winner.

Tide offers a good sign up incentive of £50 + Free Company Registration for which you can apply here.

Summary: the winner depends on your needs

Every freelancer, contractor and small business needs a business bank account.

The problem is that most freelancers and contractors sign up with whichever bank their accountant recommends, or the high street bank they use in their personal life—and remain with this bank despite the inevitable poor service they receive (read below for why you should not sign up with a high street bank).

Investing time upfront to choose the right bank will:

- save you hassle registering for the best business bank account (which is traditionally painful)

- provide a better banking experience over your years as a freelancer/small business

- potentially influence your financial life beyond your business (for example, when it's time to get a mortgage, make international payments, do direct debits, or access a financial services compensation scheme).

Summary: the business bank account winner depends on your needs

Introduction

Welcome to GoForma, your trusted source for comprehensive insights into the best business bank accounts in the UK. Choosing the right business bank account is a crucial decision for any entrepreneur. In this guide, we will walk you through the essential aspects of business banking, compare top contenders like Tide, Revolut, Starling, and Metro, and help you make an informed choice that aligns with your business needs.

We road tested the best business bank accounts out there so you do not have to.

Starting with the four contenders with the best features and costs on paper, we put them through their paces testing usability, ease of sign-up, response times and the day to day banking experience.

The full details are below, so you can experience what each one is like from the inside, without having to go to all the trouble of opening accounts with each of them.

BVA BDRC, a reputable consumer insight consultancy, consistently conducts an independent survey for the Competition and Markets Authority (CMA). The objective of this survey is to determine the likelihood of recommendation among individuals who have a business bank account. Approximately 18000 small business banking customers were surveyed for 15 banks between the time span of July 2022 and June 2023. We have leveraged the this data to compare the listed banks in our article.

It's a long article, so let's get to the conclusion and summary first for those who just want to see the results.

Conclusion

At the end of the day, different businesses have different needs and there isn't a one-size-fits-all business bank account.

Freelancers and contractors have two strong options when it comes to business bank accounts: I personally recommend you to go with Starling given its ease of use and low fees. You can get an even faster onboarding time by using this link.

However if you are more of a traditionalist and like the support that a physical branch provides, go with Metro Bank.

For a small business, Revolut is the clear winner.

Tide offers a good sign up incentive of £50 + Free Company Registration for which you can apply here.

Summary: the winner depends on your needs

Every freelancer, contractor and small business needs a business bank account.

The problem is that most freelancers and contractors sign up with whichever bank their accountant recommends, or the high street bank they use in their personal life—and remain with this bank despite the inevitable poor service they receive (read below for why you should not sign up with a high street bank).

Investing time upfront to choose the right bank will:

- save you hassle registering for the best business bank account (which is traditionally painful)

- provide a better banking experience over your years as a freelancer/small business

- potentially influence your financial life beyond your business (for example, when it's time to get a mortgage, make international payments, do direct debits, or access a financial services compensation scheme).

Summary: the business bank account winner depends on your needs

abc

Understanding a Business Bank Account

What is a Business Bank Account?

A business bank account is a specialized account tailored to manage business finances, ensuring a clear separation between personal and business expenses. It simplifies financial transactions by sole traders, partnerships, limited companies and provides valuable tools to monitor your business's financial health.

Legally, it's required to open a business bank account if you want to set up a limited company in the UK. For self-employed individual, opening a business account keeps it easy to separate business transactions from your own personal finances.

Business Account vs. Personal Account

When it comes to managing finances, understanding the differences between a business account and a personal account is essential. Here's a clear comparison:

Key Features of Business Bank Accounts

- Transaction Processing: Business bank accounts allow for a high volume of transactions, crucial for managing business cash flow efficiently.

- Multiple Payment Channels: They offer diverse payment channels, including online banking, mobile apps, and merchant services, enabling businesses to send and receive payments in various ways.

- Account Management: Business accounts provide robust tools for managing and monitoring transactions, helping business owners maintain a clear overview of their financial activities.

- Business Loans and Credit: Many business bank accounts offer access to business loans, credit lines, or overdraft facilities, providing essential financial support when needed.

- Integration with Accounting Software: Integration with accounting software streamlines financial record-keeping, aiding in real-time monitoring and accurate financial reporting.

Who Needs a Business Bank Account?

1. Business Owners and Entrepreneurs:

A business bank account is a must for all types of business owners, whether you're a sole trader, a partnership, a limited company, or you run your own business under any other business structure. It ensures that your personal finances remain separate from your business transactions, simplifying accounting and financial management.

2. Start-ups and Small Businesses:

Start-ups and small businesses, especially those in their early stages, benefit immensely from a dedicated business bank account. It facilitates financial tracking, expense management, and ease of auditing, which is critical for establishing credibility and attracting potential investors.

3. Established Enterprises:

Even well-established businesses require a dedicated business bank account. It provides a centralized platform to manage finances, pay employees, handle transactions, and manage complex financial operations that come with business growth.

4. Contractors and Freelancers:

Freelancers and contractors should opt for a business bank account to manage their payments, keep track of expenses, and ensure smooth invoicing. It enhances professionalism and makes tax reporting more straightforward.

Why do You Need a Business Bank Account?

1. Legal Compliance:

Maintaining a business bank account is often a legal requirement, ensuring compliance with regulatory and tax obligations. Mixing personal and business finances can lead to legal issues and financial penalties.

2. Professionalism and Credibility:

Having a business bank account lends credibility to your business. It portrays a professional image to clients, suppliers, and potential partners, instilling trust and confidence in your business operations.

3. Simplified Accounting:

Separating business finances from personal ones simplifies accounting, tax preparation, and financial reporting. It allows for accurate and efficient tracking of business expenses, income, and profits.

4. Tax Management:

A dedicated business bank account streamlines tax management, making it easier to identify deductible business expenses and report taxable income accurately.

Factors to Consider When Choosing the Best Bank Account for Your Business

Below are key factors to consider when choosing the best bank account for your business, ensuring you make an informed decision that aligns with your business needs and goals.

1. Understanding Your Business Needs

Before choosing a bank account, thoroughly assess your business requirements. Consider factors such as the volume of transactions, the need for loans or credit, the frequency of international transactions, and the need for specific banking features.

2. Account Type and Features

Familiarize yourself with different types of business accounts available, such as business savings accounts, business current accounts, or merchant services accounts. Each type offers unique features and benefits. Assess the account features, including transaction limits, card payments, online banking capabilities, mobile app functionality, overdraft facilities, and accessibility to ATMs.

3. Fee Structure and Charges

Be aware of the fee structure associated with the account, including monthly maintenance fees, transaction fees, ATM charges, and other service fees. Compare fee structures across various banks to find an account that aligns with your budget and transaction frequency.

4. Bank Reputation and Reliability

Choose a reputable and reliable bank known for its excellent customer service and a history of stability. Research customer reviews, ratings, and testimonials to gauge the overall satisfaction of other business owners with the bank's services.

5. Local Accessibility

Consider the bank's branch and ATM network. Opt for a bank with conveniently located branches and ATMs, especially if you need frequent in-person banking services. This ensures easy accessibility and reduces travel time for banking needs.

6. Integration with Financial Tools

Check if the bank account seamlessly integrates with popular accounting and financial management software. Integration with tools like Freeagent, QuickBooks, Xero, or FreshBooks can simplify financial record-keeping and aid in real-time financial monitoring.

7. Customer Support and Service

Evaluate the bank's customer support and service quality. Quick response times, accessibility, and knowledgeable support staff are essential for addressing any queries or concerns promptly and efficiently.

8. Interest Rates and Overdraft Facilities

If your business expects to maintain a significant balance, explore accounts that offer competitive interest rates. Additionally, inquire about overdraft facilities and the associated terms and interest rates in case you need occasional overdraft support.

9. FSCS Protection

Ensure the bank you choose provides protection under the Financial Services Compensation Scheme (FSCS). With FSCS, your eligible deposits of up to £85000 is protected in case the bank faces financial difficulties or goes out of business, providing added security and peace of mind for your business funds.

10. Terms and Conditions

Carefully read and understand the terms and conditions of the account, including withdrawal limits, deposit requirements, penalties for early account closure, and other important clauses that may affect your account usage.

Documents Required to Open Business Bank Account

- Identity proof

- personal address proof

- proof of registered business address

- estimated annual turnover

- Copy of your Companies House formation document along with your limited company number

- tax return status and VAT registration number

- number of employees

- Additional documents may require to demonstrate a clean banking and credit history.

How to Open a Business Bank Account?

Opening a business bank account is a process that involves several essential steps to ensure a seamless setup. Here's a step-by-step guide on how to open a business bank account:

- Check your eligibility

- Submit an application form, whether online or in-branch

- Provide required documents

- Wait for the approval and get your account number, sort code and, if applicable, debit card.

Switching Business Bank Accounts

The Current Account Switch Service (CASS) is a free service by UK banks and building societies, facilitated by the Current Account Switch Guarantee, aiming to simplify and expedite the process of switching your current account from one provider to another. It ensures a smooth transition, automatically transferring all your existing payments, direct debits, and credits to your new account in 7 working days.

Why have we written this article?

I am writing this article after having been lured into choosing high street banks twice, but hating the service they provided!

I first started contracting back in 2015. I didn't even realise I needed a business bank account until my accountant told me I needed one.

He recommended I get HSBC as 'it would take two weeks to open one with my personal bank' which was Natwest and he said he could speed up the process for me. I trusted him. So I made a visit to the branch he had a 'special relationship' with and sat through a 1.5 hour account opening process.

Little did I know how poor HSBC would be.

Their online accounting interface and mobile app were terrible, and it took forever to get them on the phone whenever I had issues. I happily shut the bank account down when I stopped contracting a few months later.

When I re-started contracting in 2017, I once again needed to quickly open a business bank account for a fast approaching contract. My (new) accountant recommended Santander or Metro Bank. I told him about my woes and he assured me Santander was the best business bank out there, and I could open an account online without visiting a branch.

It turns out that Santander was miles ahead of HSBC, something that highlighted why you should always compare business bank accounts.

The account opening process was smoother and the web interface was better, but the mobile app was dated and after 18 months they began charging me £7.50/month. Overall it was just 'okay'. I didn't hate it like I hated HSBC, but I didn't like it.

But with the rise of consumer-friendly challenger banks, I thought there had to be better. Sure, there may be some trade-offs vs an established high street bank, but after using Monzo in my personal life and loving it, I wanted to see what else was out there in terms of business banking and online banking.

So I investigated the 'challenger' options and am so glad I did.

High Street vs Challenger Bank

I focused my search on business bank accounts from challenger banks only.

Why?

I ruled out high street banks because after hours of reading through their business account product offerings versus challengers, I came to the conclusion that they do not provide incremental value over challengers except for physical branch network, and one challenger, Metro Bank, actually provides this.

I settled on four challengers that had the best mix of features for business bank accounts: Metro Bank, Revolut, Starling and Tide.

Metro Bank has a physical branch network while Revolut, Starling and Tide are online-only. I also considered Aldermore as it offers a generous 1% interest rate on deposits, but given the horrendous reviews it has on Trustpilot I thought it was best to steer clear of this business banking option.

Selecting the best - the criteria

I wanted to be as thorough as possible in my analysis of business bank accounts, so I opened business accounts at each of the banks (but only succeeded with 3 out of 4 banks - more on that later) and came up with a four-point scoring process.

These are the things that I believe matter most when evaluating a business banking account.

They are:

- Features vs cost on paper (including monthly fees, international payments, cash deposits, business current accounts, limited liability partnership, and financial services compensation scheme, among others)

- Sign up (how easy it is to actually open business bank accounts or personal bank accounts)

- Day to day banking (especially online banking)

- Customer service and support

The details and the experience

(1) Features vs. cost (on paper)

On paper, the four offerings for business bank accounts are quite different and all serve different needs.

Metro Bank has the benefit of offering 76 physical branch locations throughout the UK which are open seven days a week, but its online offering is weaker.

Starling is the best option great for freelancers and contractors.

Revolut is the best option for small businesses.

Let us now look into the details of why this is the case

Winner (for freelancers and contractors): Starling Bank

Starling is completely free for business bank accounts, provides incredible 24/7 support, a great mobile banking experience and includes FSCS protections for your deposits.

After evaluating all the different offerings and testing out their services, I decided to switch my business banking from Santander to Starling.

And I opened up a Starling personal account (a prerequisite for their business account, which will be an annoyance for some) and now do most of my personal banking through Starling, so everything is integrated in a simple app. Marvelous!

Here are Starling's selling points when it comes to business bank accounts:

- No fees whatsoever. There are no fees on electronic payments, UK transfers, monthly account fees or ATM withdrawals. Tide has transaction fees that range from £0.20 for transfers and £1 for ATM cash withdrawals or cash deposits via the Post Office. Metro Bank also has transaction fees (£0.30 for transfers) and a monthly minimum maintenance fee of £5 unless you keep a minimum balance of £5,000, and then the maintenance fee and transaction fees are waived. While none of these fees are hefty, it is certainly nice to save on fees when you manage your business account.

- 24/7 chat and phone support. You can reach Starling anytime, literally within minutes (see customer service section below)! Metro Bank also offers speedy 24/7 phone support for its bank account clients but it does not have 24/7 live chat (appealing to the younger demographic). Tide offers 24/7 in-app support but its phone support is not 24/7.

- FSCS protection. This insurance is absolutely essential as it protects your deposits up to £85,000 if your bank fails. Starling and Metro Bank offer this, but Tide does not. This is a deal breaker for Tide.

- Integrations with Xero and FreeAgent. You can link up Starling with popular accounting software for freelancers and contractors. Tide offers both of these and Sage as well (so has an advantage over Starling), but Metro Bank only offers Xero. Most contractors and sole traders in the UK use FreeAgent (a separate account), so this is the one that really matters.

It's not surprising that Starling won Best Business Account provider at the British Bank Awards 2019.

There are of course some downsides with opening a business account with Starling, namely:

- No physical locations: Metro Bank has a huge advantage with its physical presence. With the advent of online banking, physical branches are no longer a necessity but is always nice to know you can access one if you need it. And on top of that, Metro Bank branches are open seven days a week. Metro Bank clearly wins here.

- App only: You can only use Starling (for your personal bank account or business bank accounts) via a mobile app. Tide offers a mix of desktop and app, whereas Metro Bank offers desktop, app and physical branches. While this is certainly a downside, Starling's app is so easy to you use that rarely are you left wanting for something more.

- Fewer business-friendly features than Tide: There are some great features Tide has that work really well for freelancers, sole traders, and contractors such as the ability to send invoices and cards for team members linked to the same account. Tide definitely edges Starling out in this regard.

In summary, Starling slightly edged out Metro Bank for me.

It's free business account with great online experience beat out a physical branch presence. This is a toss up really - many people would prefer the security of physical branches.

Tide put up a good showing, but its lack of FSCS protection was a deal breaker. After all, Tide is a start-up and is at a much higher risk of failing than a more established bank. And in the small chance this happens, no one would want their savings to go along with it...

Revolut is already more established than Tide but its lack of FSCS protection on top of its poor customer support options and transaction fees push it down to third place as a business account option for most freelancers/contractors, most of whom will have little use for Revolut's power features.

Winner (for small businesses): Revolut

Revolut's offering is almost exclusively geared towards small businesses and away from freelancers and contractors, both in terms of pricing and features.

Its pricing is steep. Account holders pay £7 a month (freelancers/contractors/sole traders) and its small business starter package costs £25 a month (with its 'scale' and 'enterprise' packages coming in at £100/month and £1,000/month respectively).

Whilst Revolut does offer free accounts, in practice these have very little functionality before you begin to pay transaction fees.

Where Revolut really delivers is in power features for three major types of business users:

Those with multiple employees looking to simplify expenses

- you can easily issue prepaid cards to multiple team members

- team members can submit expenses for approval to be paid

- and there is a built in dashboard to track expenses

Those transacting in multiple currencies or who have employees travelling

- hold, receive and exchange 29 currencies, which is very impressive.

- exchange, transfer and receive 150 currencies at the inter-bank exchange rate.

- any employee can spend abroad using a Revolut card and pays the interbank rate on FX.

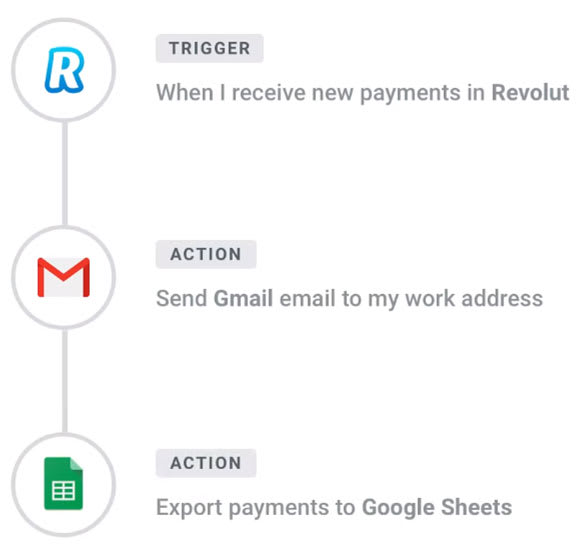

Integrations for power users

- popular accounting software such as Xero and FreeAgent (with more on the way)

- Slack (the popular messaging app) and impressively, Zapier which is a tool that integrates thousands of apps with each other, allowing you to easily move information between them.

- on top of this, Revolut also has an API

- these features make it great for for power users who want to integrate Revolut into their work flows. See below for a simple workflow that is possible using Zapier to connect Revolut and Gmail:

This functionality and customizability make Revolut an easy choice for small businesses.

(2) Sign-up process for business bank accounts and personal bank accounts

Time is valuable.

Whenever I started or restarted contracting, I found myself only having a few days between landing a contract and needing to start work. This meant getting everything in order quickly - setting up a limited company (and register it at Companies House), finding an accountant, getting insurance and getting a business bank account.

I wanted to quickly and easily sign up for an account without having to visit a branch or chase / stay on top of things. I thought the challenger banks would be clear and away winners vs. high street banks, but I was unpleasantly surprised.

Business account winner: Revolut

Revolut had far and away the smoothest account opening process. I opened an account through their website immediately.

Simply fill in all the information they require (unfortunately more than Tide or Starling did), go through their security check, choose your pricing plan and then make a transfer to the account of at least £1 and voila - your account is open!

Initially I was told it would take about two weeks to receive my Revolut card in the mail (which I was a bit shocked by - two weeks in the day and age of Amazon Prime?!) but the card came in five days.

The card looks beautiful and has a nice feel to it. While it is metallic, it isn't very weighty compared to say, the new American Express Platinum metallic cards.

Revolut also has a really strong set of onboarding emails that introduce you to the myriad of features they provide.

Business account 2nd place: Tide

Tide also had a pretty slick sign-up process but it took 48 hours to get actually get the account opened.

After initially downloading the app and starting the account opening process, I began to lose faith.

I found the registration process a bit buggy. For example there was no way to choose the focus of my business, and it was clunky to enter in my birthday. These are small things but for a company that is completely app-based, it erodes trust.

However low and behold, after about 10 minutes I was able to enter in all the requisite information, run through the security check and conclude the signup process. I was told it would take between 5 minutes and 48 hours to open my account.

Unfortunately I fell into the 48 hour camp, which was a tad annoying at first. However after I struggled to open accounts at Starling and Metro Bank, Tide's process seemed like a breeze.

A few days later I received the Tide card in the mail!

The card was scratched, and I don't love the design of the card, but hey - these are all minor things!

Business account 3rd place: Starling

I had an awful process getting Starling set up. On the surface, the process was super smooth - in less than 10 minutes I had whizzed through the app and security check and was told my account had been opened immediately.

Hurrah! Or so I thought.

A week later I sent my client an invoice and asked them to pay it into my new, shiny Starling account. However, the payment bounced. It turns out my Starling account hadn't been opened after all. This was very strange to me, because they had even sent me my card in the mail.

After digging through the app, I realised Starling's customer service team had sent me a message shortly after I thought I had opened the account requesting I answer another 8 questions about my business.

It was frustrating because I had absolutely no idea I needed to provide this information and the questions seemed extraneous e.g. what are your business goals for the next year and where are your customers located. Tide and Revolut did not ask these questions.

After providing the information , I received ANOTHER request from Starling for additional documentation. You think they'd build all of this into their application process.

But after a month of initially thinking I had the account set up, I finally did. It was a painful process and is definitely something that needs to be fixed.

Business account 4th place: Metro Bank

If you thought Starling's account opening process is awful, wait until you try and open an account with Metro Bank.

I called my local branch to see if I could make an appointment and they said I could not, and that I should budget two hours for the account opening process.

Two hours!? And on top of that, I had to dig up documents to prove my address. But in the name of thoroughness for this article, I proceeded.

After waiting 20 minutes to see a representative, I was greeted by a young lady that would be responsible for opening my account. About 30 minutes into the account opening process, I was informed that my address had been flagged for fraud through a CIFAS check. I immediately became worried.

But as I questioned her more, it turns out that someone in my postal code had attempted to fraudulently use an address to sign up for financial products, not even my address! There are easily over a hundred flats and homes in my postal code. It is a completely absurd security check.

She informed me she would need to do additional checks and that if I passed, I would need to come back to the branch to re-start the process. When I asked her how many people fail the check, she said over 50%. I was dumbfounded at the stupidity.

I was informed I passed the check and went back into the branch to start the account opening process once again. And of course, my profile had not been saved from the first time I went in, so I needed to answer the same series of questions again.

I told the representative that we needed to open the account within 60 minutes or I was leaving and he rushed through the process to get it done. Kudos to him. However he informed me that my application still needed to be approved before the account would be opened.

Three few days later I received an email notifying me that my account had been opened and inviting me to set up online banking, and a letter in the mail brought my debit card and a 'secret word' required to set up my online banking.

The online banking set-up process was a bit cumbersome as I was required to enter my 'customer number' but Metro Bank did not provide this to me, so I had to call in to get it. But soon thereafter I was in!

(3) Day to day banking

Business account 1st place: 3 way tie between Revolut, Starling and Tide

All three of the online-only offerings were extremely clean, intuitive and easy to use.

They each offer marginal pros and cons. For example I found Tide's app the most intuitive, but Starling offers seamless integration between your personal account and business accounts. Below I've shared a bit more about each (in alphabetical order).

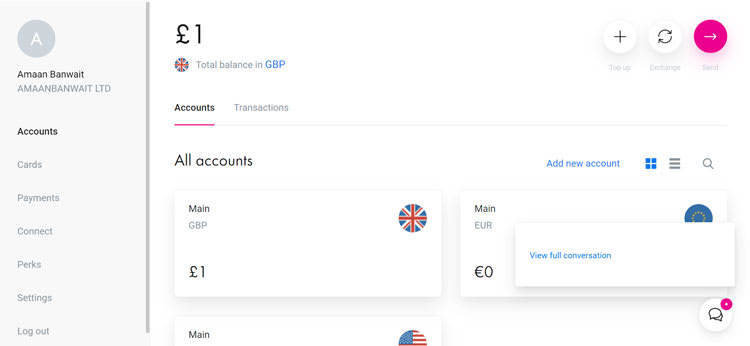

Revolut

Revolut pushes users towards using its desktop solution versus its mobile app, I think because it offers so much more functionality than the other offerings that it is easier to manage on a computer with a larger screen.

The interface is clean and very easy to get a handle on. See a screenshot below of the welcome screen.

As I played around with different features I found it fairly easy to take advantage of Revolut's advanced features, such as ordering new physical cards, setting up virtual cards, and transferring money from my GBP account to my EUR account (this works for both your business account or personal account). Well done Revolut!

I believe the expense management features are a big plus, too.

Now, employees can easily spend abroad on a business card without having to separate personal from business expenses. To integrate expense management features offered by the likes of Concur and KDS directly into banking is a huge win.

Revolut wrote a good article about how it built its banking offering in this medium post, which is worth a read

Starling

As I mentioned above, after I tested the offerings of all the different providers, I promptly set in motion the Current Account Switch from Santander to Starling.

I've now been using Starling for a few weeks and it has been fantastic. The app is clean, fast and easy to use. Sending payments is a breeze and all my business and personal account expenses are neatly categorised.

I am a big fan of simplicity and a huge selling point for me was integrating my business and personal banking into a single view. In fact, Starling makes having a separate business bank account and personal accounts easier.

With Starling I have both my business accounts and personal account in a single app and can easily transfer between them. In addition, the interfaces are the same so I don't need to remember the layouts and quirks of different offerings.

A downside of Starling is the lack of a desktop version. I thought this was going to be an annoyance for me, but I have found the app so easy to use that I haven't missed having access to a desktop version.

Tide

Tide offers both mobile app and desktop. I found the app very cleanly laid out and intuitive, even more so than Starling's and Revolut's apps.

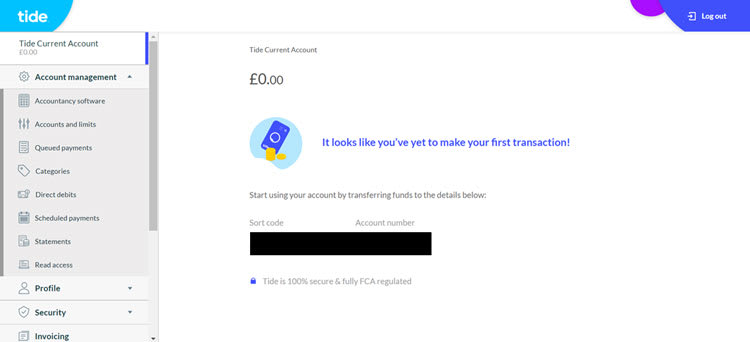

Tide's desktop offering was also extremely well laid out. Here's a screenshot of the the first thing you see when you log in, as well as how the menu structure is laid out on the left. I like how all the functionality is in a single, clean menu, which many banks complicate.

Tide also offers integrated invoicing, which I was excited to try out. While it was fairly simple to set up an invoice, it was overly simplistic. I could add multiple line items and a fixed amount for the service.

But what about when I am charging a client for 18 days of work in a month? Or specifying different currencies? I cannot create multiple columns like I can in excel to specify the number of days worked and day rate, or the FX rate. So while it is great in theory, it did not quite meet my needs.

A big downside of Tide is that it does not offer personal accounts. While this isn't a dealbreaker, it is nice plus to be able to integrate your personal and business banking in a single place.

Business account 4th place: Metro Bank

Metro Bank's desktop offering is more akin to a traditional high street bank.

It was certainly easier to use than HSBC or Santander, but still a ways off from the likes of Revolut and Tide. For example I had to go through four steps to make a payment, which felt cumbersome.

Its app on the other hand is much closer to the online-only players. It was clean and easy to use, albeit not having the same modern user interface and design.

Metro Bank also offers the ability to integrate your personal and business banking in a single app, similar to Starling. This is certainly a plus.

Overall, all four providers performed very well on day to day banking, with Revolut, Starling and Tide slightly edging out Metro Bank.

(4) Customer service

Customer service is of course an extremely important component of any banking service.

If you need to make changes to your account, or if your account is frozen (which seems to happen often these days), you want to know you can reach customer service quickly and easily to resolve your issues.

Business account winner: Starling

Starling actively advertises 24/7 human support, and they deliver!

I tested this by contacting their customer support via the live chat in the app at 5:30am and received a response within three minutes. Pretty good! Younger freelancers and contractors often prefer live chat and app-based support to calling in.

As for Starling's phone support, I tested the phone lines at 6:30am and got UK-based support on the phone in less than 60 seconds!

This combined phone & live chat support with responses in minutes is unheard of in today's banking age.

Business account 2nd place: Metro Bank

Metro Bank advertises its 24/7 call centre and the response times are fantastic. I called on two separate occasions, once inside of UK business hours and once outside, and after navigating a few menus, got someone on the phone near instantly - even faster than Starling!

Metro Bank also has an edge on the others with its physical banking presence. However, I personally found that the branch provided fairly poor service. The staff did not follow-up on messages they said they would send me, did not respond to emails on multiple occasions, and ranged greatly in speed and friendliness.

If Metro Bank provided a better in-branch experience they would have won.

Business account 3rd place: Revolut

Revolut's customer service is poor at best. They do not offer any phone support whatsoever, so everything must be done through their 24/7 live chat.

However I found the response times to be extremely slow. It took me 1 hour and 16 minutes to receive a response to a simple question.

This is simply unacceptable when you do not offer phone support, especially for a business customer. After speaking to a few other people who have dealt with Revolut's customer service, they attested to the slow response times. It seems Revolut still has a ways to go in this regard.

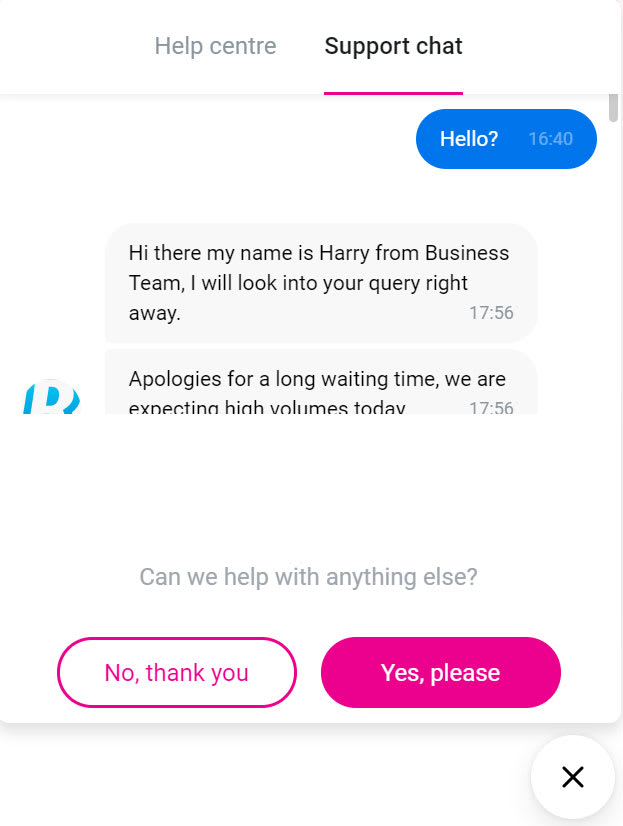

Business Account 4th place: Tide

If you're looking to do business banking, it's vital to compare business bank accounts.

Tide's service is slower than Revolut's (ouch). They only offer phone support for lost and stolen cards, and push their members towards their in-app live chat and email.

However, both of these channels are extremely slow. I had an issue activating my mobile app so tried emailing Tide, and it took 1 hour and 18 minutes to get a response. Not terrible, but this is nowhere near having someone on the phone in 60 seconds with Metro Bank and Starling.

The live chat is even worse. I waited over 2 hours for a response to a simple question. The combined lack of responsiveness to email/in-app chat and limited phone support is completely unacceptable in my opinion.

Partner with GoForma to Choose the Best Business Bank Accounts

Selecting the right business bank account is crucial for your business's financial stability and growth. At GoForma, we not only provide comprehensive insights into the best business bank accounts but also offer tailored business accounting services to streamline your financial operations. Make the right choice for your business today and trust GoForma for expert guidance and support. Book a Free Consultation now to take the first step towards financial success!

%20(1).webp)

.webp)