Limited Company Director's Withdrawal

A limited company stands as a distinct business structure and has its own legal identity apart from its owners (shareholders) and managers (directors). In the UK, there are three primary types of limited companies:

- private company limited by shares

- public limited company

- private company limited by guarantee

After setting up, accessing the company's profits and taking money out of a limited company is not a straightforward process. It becomes a legal entity when it's incorporated at Companies House. Meaning that, the company's assets and profits belong to the company itself, not to the business owner. Unlike a sole trader who can easily withdraw funds, the process for taking money out of a limited company is more complex. In this comprehensive guide, we'll break down the various methods available to you, ensuring you make informed decisions tailored to your unique circumstances.

A limited company stands as a distinct business structure and has its own legal identity apart from its owners (shareholders) and managers (directors). In the UK, there are three primary types of limited companies:

- private company limited by shares

- public limited company

- private company limited by guarantee

After setting up, accessing the company's profits and taking money out of a limited company is not a straightforward process. It becomes a legal entity when it's incorporated at Companies House. Meaning that, the company's assets and profits belong to the company itself, not to the business owner. Unlike a sole trader who can easily withdraw funds, the process for taking money out of a limited company is more complex. In this comprehensive guide, we'll break down the various methods available to you, ensuring you make informed decisions tailored to your unique circumstances.

Who Can Take Money Out of a Limited Company?

In a limited company, the individuals authorised to withdraw money are typically directors and shareholders. But hold on, it's not a free-for-all. Just because you're a director or a shareholder doesn't mean you can grab cash whenever you want. There are rules and regulations to follow. The company has to be making profits, and the methods used to take out money need to be legal.

Ways of Taking Money Out of a Limited Company:

As a limited company director, there are three ways in which you can withdraw money from your company:

- Director’s salary through PAYE

- Issuing dividends

- Director's loan

- Reimbursement of limited company expenses

1. Director’s Salary through PAYE

This is the most obvious method to take money out of a limited company. Company directors are employees of their business who need to register with HMRC for PAYE and pay National Insurance Contributions on their earnings.

The money you use for salary payments is considered a tax-deductible expense, meaning your company won't owe any Corporation Tax on it. However, it's important to note that if your annual salary earnings exceed the NIC secondary threshold of £9,100 (for the 2023/24 tax year), the company will need to pay 13.8% in Employer’s National Insurance contributions on the exceeding amount.

Many directors choose to keep their salary up to the National Insurance Contributions primary threshold, which is £12,570 per year. By doing this, they can avoid paying both Income Tax and NIC on this portion of their income. This strategy allows directors to stay eligible for the State Pension and other benefits because they are earning above the lower earnings limit of £6,396 per year.

The remaining part of your income can be taken as dividends. Notably, the first £1,000 of dividends is tax-free on account of the annual dividend allowance.

2. Issuing Dividends

Dividends are payments made by a business to its shareholders, typically in the form of cash or additional shares of stock. As a company shareholder, you can take your share of business profits as dividends. It is a very tax-efficient way of taking profits out of a limited company.

Your company will distribute dividends based on the percentage of ownership reflected by your company shares. If you are the sole shareholder, you have the right to receive all the remaining income after deducting costs, expenses, and taxes.

Companies pay Corporation Tax on all taxable income, and dividends are paid from the profit that remains after tax deductions. The first £1,000 of annual dividend income is exempt from tax. Above the £1,000 dividend allowance, the following tax rates are applied based on your Income Tax band:

- Basic rate: 8.75% up to £50,270 annual income

- Higher rate: 33.75% between £50,271 -£125,140 annual income

- Additional rate: 39.35% above £125,140 annual income

To issue dividend payments, you must "declare" them at a board meeting of the director(s), and minutes of such meetings must be recorded. This procedure applies even if you are the only company director and shareholder.

In such cases, simply record the issuance of a dividend to yourself on a specific date and keep a dividend voucher containing payment details.

Illegal dividends

Dividends can be issued only if a company has retained profit after deduction of all the costs, expenses, and business taxes for the current financial year, and after taking into account any retained profits and losses from previous financial years. If no profit remains after the deductions, dividends cannot be paid. Any unauthorised dividend payments may lead to an HMRC investigation and penalties.

3. Director’s Loans

- Another tax efficient way to take money out of your limited company is a Director’s loan. This method is used to:

- lend money to your company

- borrow money from your company that exceeds the amount you have invested into the business

- reclaim money that you have previously invested into the company

You must keep the record of such loans in the director's loan account and show it in your company's balance sheet.

A loan account maintains an ongoing record of funds deposited into the company by a director or withdrawn from the company by a director. Balances in the loan account indicate whether it is 'in credit,' 'nil,' or 'overdrawn,' in the same way as the status of a personal current account with an overdraft facility.

If you withdraw more funds than you've contributed to the business, your director's loan account will be in an overdrawn status. The amount of money owed by a director to the company or vice versa, and the duration of the overdrawn loan account, determine tax liabilities for such accounts. If the company owes you money, your loan account will be in credit, allowing you to reclaim the amount without incurring personal tax liabilities.

If you owe your company less than £10,000:

- You will not have any personal tax liabilities, but there may be tax implications for the company.

- If the loan account remains overdrawn for more than 9 months and 1 day from the company’s accounting reference date (ARD), the company must pay Section 455 Tax at 33.75% on the overdrawn amount.

- You must disclose the outstanding loan amount in the Company Tax Return.

If you owe your company more than £10,000:

- You are required to declare the loan in your Self Assessment tax return.

- In some cases, income Tax may be applicable on any interest due on the loan.

- The company must deduct Class 1 National Insurance on the loan.

- You must report the outstanding loan amount in the Company Tax Return.

- The company has to pay Section 455 Tax at 33.75% of the overdrawn amount.

At the time of loan write-off (non-repayment):

- Your company must deduct Class 1 National Insurance through payroll.

- You are required to pay Class 2 and Class 4 Income Tax on the loan through Self Assessment.

4. Reimbursement of Limited Company Expenses

In certain instances, you may be paying business expenses from your own pocket. You can reclaim these expenses if they were incurred solely and exclusively for business purposes. Additionally, your business can benefit from tax relief on these expenses.

Below are some examples of allowable limited company expenses:

- Use of home as office

- Business travel expenses

- Stationery and Equipment expenses

- Business insurance

- Mobile phone, landline and broadband expenses

- Financial and legal expenses

- Professional subscription

- Donations

Your company has the flexibility to reimburse expenses either with your monthly salary or at another convenient interval. To claim reimbursement, it is essential to keep receipts (for a minimum of six years), fill out claim forms, and record the expense refunds in the company's accounts.

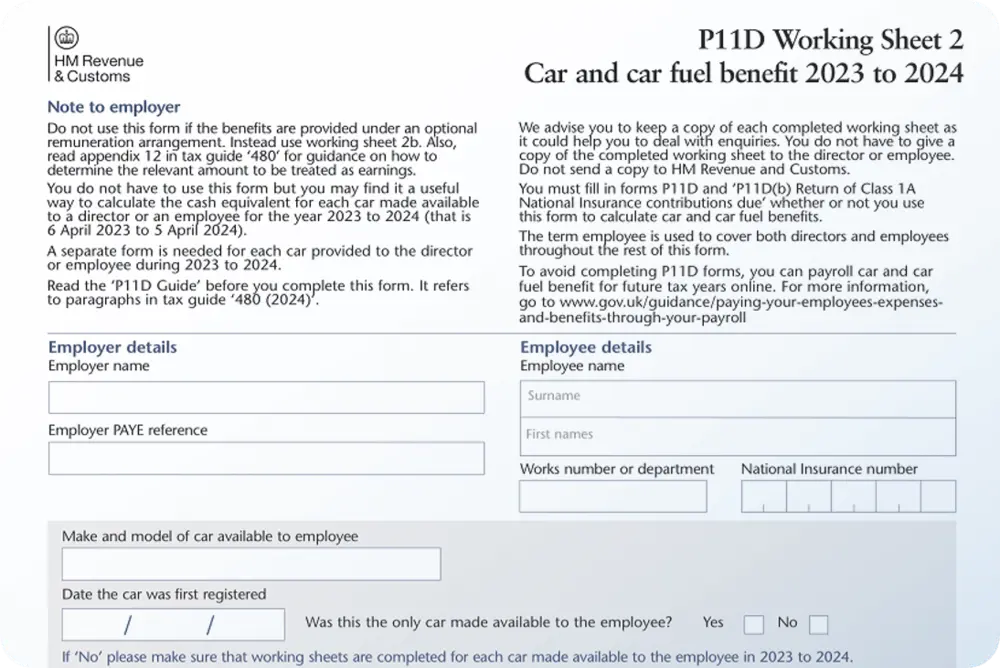

At the end of each tax year, you must complete the P11D form to show the total claimed expenses. You must include these expenses in your self assessment tax return or you may end up owing tax on this money.

In its annual Company Tax Return, the company should include any expenses reimbursed to directors or other employees in the employment section. HMRC recognizes this reimbursement as an allowable expense, relieving the company of additional tax liabilities.

Taking money out of a limited company requires thoughtful considerations about different methods like salaries, dividends, loans, and expense reimbursements, choosing what works best for your situation. To make things easier and smarter, it's highly recommended to hire experienced limited company accountants. They can give you personalised advice, make sure you follow tax regulations, and help with smart financial strategies. These professionals don't just help with getting money from the company; they play a big role in keeping your finances healthy and making smart decisions for the business.

%20(1).webp)

.webp)